Market Report

Get the latest market insights for our Quantitative Trader, Ilya Byzov, based in our New York office.

23 April 2024

Last week, the coffee futures market rallied 11.4 cents from Friday to Friday to end at 231.85 USc/lb. Last week, I wrote that unprecedented speculative money inflows would continue to test the highs of late 2022’s rally at 239 before the May first notice day gives some indication on nearby willingness to hold ICE certified inventories. It looks like the exact situation occurred with funds adding another $869 million to their net long position in coffee over the week to get to $3.7 billion over the last 4 week period. Funds as of Tuesday were just shy of record long in both USD value (+$9.3 billion vs. +$9.9 billion record in a post-frost market of Nov 2021) and net futures (+53,433 lots vs. +58,960 lots record in a similar singular rally of Nov 2016). Coffee futures prices came as high as 241.70 and got above the 239 target level on Wednesday before buying dried out and futures tumbled 10 cents into the May first notice day. With the May contract into the delivery period and plenty of ICE certified stocks to satisfy nearby demand, as well as several hundred thousand bags of excess exports from Brazil that are likely destined to deliver to the exchange, it is likely that we will see the market pull back this week and consolidate around the 215-220 range as buyers take a pause and sell-side liquidity from farmers returns.

16 April 2024

Last week, I wrote that I expected the market to pare back this week to a new possible support level of $2. To my dismay, coffee futures continued to rally this week, rising 9.45 cents from Friday to Friday to end the week at 220.45 US cents/lb basis the now most active July contract. The rally continued unabated with prices rising for each of the 5 trading days and at one point on Friday trading at 229.75, the highest level since September 2022 when a rapid reduction in visible arabica supply including dwindling ICE certified stocks prompted a panic rally. That rally ended precipitously by the roaster not willing to chase the market higher and finding themselves with ample internal inventory and a price-conscious consumer starting to scale back on coffee purchasing as a way to reduce their expenditures in an uncertain economic environment. While the overall economic picture since Q4 2022 has strengthened significantly and especially in Europe, it is important to point out that most major beverage analysts still indicate a contraction in coffee sales by volume in nearly all categories in the US and EU, including R&G sales, out of home coffee purchases, single serve and ready to drink. Our own figure for overall coffee demand in the 22/23 season was a contraction of 2.7% for Consuming countries. Even with our most recent estimate of 2.2% growth for 23/24, we do not see the developed consumer market returning to pre-pandemic levels from a green coffee usage perspective until next year. The reason is of course inflation and consumer pressure, but also higher efficiency of coffee brewing and increasing competition from tea based caffeination in the RTD beverage sector. The silver lining for all specialty roasters reading this excerpt is that all statistics point to the specialty market taking an ever larger share of the overall pie and therefore continuing to grow. At some point, I believe that these variables will become relevant today in our market, but it is unlikely to be this week. This week, coffee seems to be caught up in the hype of record speculative investment levels and memeified story hunting, with funds adding another $1.1 billion of length to the coffee market, with coffee spec long AUM sitting over 50% than one month ago. Therefore, I expect funds to continue to test the highs of late 2022’s rally at 239 before the May first notice day gives some indication on nearby willingness to hold ICE certified inventories.

9 April 2024

This week, coffee futures basis the most active May contract ripped 22.15 cents higher from Friday to Friday to end the week at 211.00 USC/lb. I wrote last week “we do see outside commodity markets and the psychological pressure continuing to influence the market this week, and I see $2 as a hard point of resistance for new selling, and on the downside it seems that significant support is emerging at 185 USc/lb.” The market indeed rallied strongly on Tuesday and Wednesday, propelled mostly by concerns of defaults and restricted supply in Vietnam’s Robusta market. Additional pressure of new money coming from the cocoa sector and trying to equate the story in Cocoa with Robusta, and by corollary, Arabica, sent the market through the $2 resistance level with ease. With the critical resistance level easily broken, new momentum speculators engaged while shorts began to panic. While significant selling of coffee from producers did emerge, it did little to prevent $1.2 billion of new speculative investment in coffee futures over the week ending Tuesday (COT report cutoff). We are currently looking at possibly the largest net speculative position in coffee futures in history without a significant story to merit its existence, outside of “cocoa market is crazy”. Ample supply from origin is emerging at these levels, while excess Arabica inventory continues to arrive ship after ship into the port of Antwerp. With overall consensus by roasters being an overall contraction of coffee demand in the United States so far this year, it seems that even the world’s most resilient economy is not feeling recovering demand from a fiscally tight consumer. However, once the spigot gets turned on, it takes time for speculative interest to stop and reverse. The first test will occur early this week as heavy Brazilian selling pressure should emerge if the producer is indeed well capitalized with excess inventory still around and harvest coming up. Second, the Index roll is typically a negative event where the May-July spread will be sold by passive money managers as their position rolls into a future month. Lately, this has been an opportunity for spread bulls to buy into the expiry period. However, this time I believe that speculators will be less willing to take delivery of ICE Arabica stocks due to its higher price, higher interest rates, and the near doubling of stocks since March lows. Overall, I expect the market to pare back this week to a new possible support level of $2.

2 April 2024

This week, coffee futures basis the most active May contract rose 2.95 cents from Friday to Friday to end the week at 188.65 USC/lb. Despite ICE Arabica certified stocks continuing to grow by 27 thousand bags this week to 595 thousand, or more than double the stock levels seen at the beginning of this year, the market continues to see upward pressure. The main driver seems to be roaster panic regarding lack of futures coverage in the nearby contract following the excitement surrounding the March/May spread. It is clear that roasters have let their coverage run low due to the elevated price environment in expectation of prices to ease. This is more apparent in Robusta, where a fresh rally was triggered last week on what seemed to start as panicked roaster buying. The additional pressure from the Cocoa market trading at all time highs seems to be making a psychological impact as well. Commercial Longs, a common proxy for roasters, added 10,125 lots to their coverage over the last 3 weeks, or 20% of their position and are in a much better situation to cover exposure in the upcoming may contract expiry. However, we do see outside commodity markets and the psychological pressure to fix continuing to influence the market this week. I see $2 as a hard point of resistance for new selling, and on the downside, it seems that significant support is emerging at 185 USc/lb.

26 March 2024

This week, coffee futures basis the most active May contract rose 1.9 cents from Friday to Friday to end at 184.85 USc/lb. The main drivers behind the market this week has been extremely supportive roaster buying. The Commercial long category, which typically signifies roaster coverage, grew by 7,121 lots (13.5%) this past week, to the highest level since November of last year when the market was trading in the 160’s. While commercial roasters typically like to fix their futures coverage as low as possible, I believe outside pressure from other commodities has been forcing them to buy coverage here to prevent escalating risks. Of particular importance is the Cocoa market, which has seen prices rally a whopping 73% in 2024 after rising 61% in 2023. In cocoa as far as I understand, industry faced 2023 in a similar manner as in coffee – by going hand to mouth with their coverage on the physical and futures side in order to avoid paying up at record price levels. This left them in a bind when prices continued to go higher this year, resulting in panic where desperate industry players were scrambling to get cocoa and also be forced to chase the market higher on the futures side. The surprising action on the March/May spread in coffee has also caught a lot of roasters off guard, forcing them to pay up at the end for maintaining a speculative view that futures prices will fall to their financial target level. It seems now that lesson has been learned and roasters are adding coverage at the 180 USc/lb level in order to avoid getting surprised by price action when the May contract approaches expiry. As a result, prices remain quite resilient at 180, so we would expect this level to act as a strong support as prices head there this week.

19 March 2024

This week Arabica coffee May '24 futures dropped 1.26% to end at 182.95 USC/lb highlighted by price levels falling to a 2-week low as certified stocks reached their highest level since October. The market has been deeply engrained within a 3-month range where highly volatile sessions remain a risk. The January 18th low of 173.10 remains intact and acts as a strong support level to this range. By the same token, the February 12th high of 194.05 also remains intact and is a key resistance level. Any break to these levels could signify a change in the market's directional momentum. Downward pricing pressures may begin to unfold as certified stocks recover. With inventories trending in an upward trajectory, stock levels could eventually grow too big for the market to sustain current levels. Total certified inventories now sit at 488,678 bags, up more than 100k since the start of the month, with 154,630 bags still awaiting analysis. Pass rates have hovered between 50%-75%.

12 March 2024

This week Arabica coffee May '24 futures rose 0.90% to end at 185.20 USC/lb. Trading was characterized by highly volatile sessions. A combination of factors such as Brazil's beneficial weather, certified inventories rising, Robusta tightness and Colombia's reduced production outlook influenced price behavior. Certified stocks have risen above 400,000 bags for the first time in the last 6 months. A highly volatile week saw prices gain only 0.9% but closed almost 5% below the week's high. Cross commodity flows seemed to also affect coffee, as major rallies occurred both in cocoa and cotton due to supply challenges. Speculative interest and Robusta tightness could keep the market near the 190s resistance level, that is until the reality of ever-larger shipments of coffee out of origin make their way into very lukewarm global demand.

5 March 2024

This week, NY futures rallied 7.5 cents from Monday to Monday to start the week at 187.1 basis the most active May contract. Last week, I wrote that I expected to see prices continuing to erode this week to 175, where some roaster buying pressure is expected. We did get to a low of 177.50 on last Tuesday before the market turned around while huge buying support emerged. It seems that roaster coverage continues to be quite low, which puts a floor whenever coffee futures approach the bottom of the recent trading range. Overall, demand expectations by large roasters continue to be lackluster, so they are happy to reduce coverage and be forced to cover some at the last minute rather than fixing everything forward at once and having prices then come down for the industry, leaving them at a competitive disadvantage. Cross commodity flows seemed to also affect coffee, as we saw major rallies occur both in cocoa (due to limited nearby supply and production issues in West Africa) and cotton (due to dryness and some fire issues in Texas). Some cross-asset money flows into a soft commodity such as coffee and sugar can be expected, especially if coffee also faces similar conditions in terms of market backwardation (where prices decline as you go further out). Therefore, the combination of new speculative interest is likely to run us to the 190s resistance level this week, before the reality of ever larger shipments of coffee out of origin make their way into very lukewarm consuming country demand.

27 February 2024

This week, NY futures prices fell 6.4 cents from Friday to Friday to end at 180.30 basis the most active May futures contract. Two weeks ago I wrote that “overextended speculative position makes my prediction this week a fall to the 180-185 cent range.” Overall, this situation played out and we fell to the bottom of my expected range. The March/May spread is now in the delivery period where actual physical coffee is being exchanged between those who are long march and those who are short. With an active open interest above 800 lots it seems there is quite a bit of interest in parties taking ownership of ICE certified stocks. Perhaps this is due to increased demand or at least an increase in the perceived value of owning spot inventory. On the other hand, we now have seen ICE certified stocks grow by 17k bags and stocks to be graded (if they pass, they are allowed to be added to certified stocks) almost double to 127k bags. Shipments to the most attractive certification port of Antwerp continue to be very strong from Brazil, Honduras and Peru (typical origins that certify coffee to the exchange). With spreads continuing to stay inverted, it is likely that excess inventory is not going into increased roaster pipelines of the EU, but is rather headed for the exchange. Therefore, I see prices continuing to erode this week to 175, where some roaster buying pressure is expected.

13 February 2024

This week, coffee futures basis the most active May contract rose 2.75 cents from Friday to Friday to end at 191.75. Last week, I wrote that following the Index roll from March to May, I would expect the market to strengthen back to 190-195 and become highly reactive to spread movements for direction. While this seems to have occurred, the impetus for the tightness on the March-May spread has been lacking of late as more and more coffee arrives to refill the pipeline of ICE certified exchange stocks. Often seen as the backbone of the coffee futures contract, ICE certified stocks are washed arabicas that were purchased cheaply and, if passed by the committee of exchange graders, would comprise the inventory that one would take ownership of if they were to take the coffee futures contract into delivery. For several months the aggregate value of ICE certified stocks has been critically low, hitting as low as 224,066 bags as of November 30th. Since then, certified inventories already have rebuilt 73,659 bags or 33% from the lows with another 30,534 bags pending to be graded and more on the way to destination ports. While the composition of the certified inventories as well as the rates at which gradings pass have been hodgepodge, inventories seem to have clearly turned a corner. The reason for this is that the exchange is often seen as a buyer of last resort for commercial participants facing an unprecedented inversion in the spread. Therefore, rather than carrying coffee, a trade house could choose to certify cheaper coffees and deliver them against the March futures contract. The higher the nearby spread goes, the more likely additional inventory will now come to be delivered to the exchange. Additional spread tightness extending to the May-July contract would put pressure on trade houses to ship cheap Arabicas from origin more quickly, adding to inventory levels and satisfying nearby demand. This phenomenon along with what seems to be an overextended speculative position makes my prediction this week a fall to the 180-185 cent range.

6 February 2024

This week, coffee futures basis now the most active May contract fell 0.45 cents from Friday to Friday to end the week at 188.15 USc/lb. The timeline for the majority of positions rolling from the March to the May contract occurred earlier than is typical. In fact, only once in 33 years did the Open Interest for May become bigger than March this early in the year. The reason this is relevant is because it highlights the implicit fear that many market participants have regarding the increasing inversion of the March/May spread. This spread started the week at +4.4 cents and softened over the course of the week to end at +2.95 cents. It seems that many saw that level as good enough to exit their March positions as the nearby situation of Arabica supply remains uncertain. Indeed, stocks in European ports have gone to the lowest level in 20 years, and stocks in the USA, while becoming much more difficult to measure following the dismantling of the Green Coffee Association’s report, are still estimated to be the lowest in nearly a decade. The implication on the market for this kind of situation is to incentivize holders of coffee to release it by creating a premium for nearby sales relative to future sales. This type of situation also typically is followed by committed speculative buying as inverted and tight spreads signify a shortage of physical product. This week, we can expect the spread pressure to ease a little as the Index typically rolls its positions from March to May.. Following this roll, I would expect the market to strengthen back to 190-195 and become highly reactive to spread movements for direction.

30 January 2024

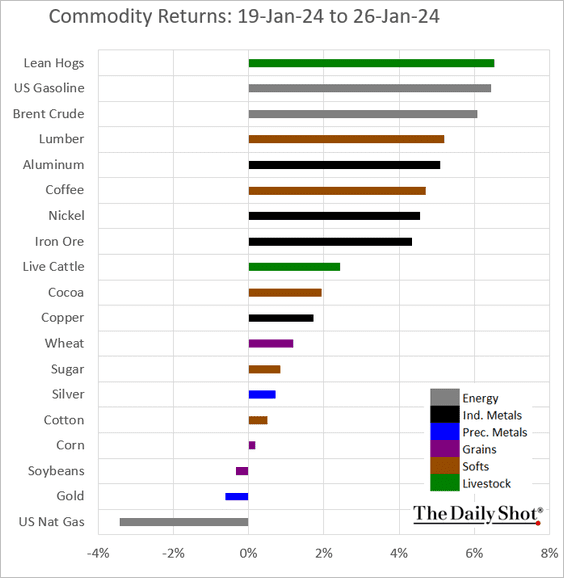

This week, coffee futures prices rallied 8.7 cents from Friday to Friday to end at 193.85 USc/lb basis the most active March contract. The strong performance of the market can be attributed to increased feelings of unease over nearby availability of Arabica at destination markets. The March/May spread moved from a 3.3 cent inversion to as high as 5.95 cents on Tuesday, which equates to a $2,231 penalty per lot of futures that has to be rolled over the 2 month period, and doesn’t include costs of warehousing or finance. Therefore, the market is punishing owners of inventory in order to incentivize selling nearby, or if possible, to bring coffee more expeditiously from origin. The issue is that the spread and flat price are often tied due to certain momentum traders seeing spread tightness as an indicator for a supply crunch, causing them to buy outright futures. The second factor helping the market rise this week has been strong cross commodity buying. US economic performance well exceeded analyst expectations for Q4 2023, sending a ripple effect across all markets to buy mode. To add to this, the Chinese central bank indicated support to its struggling stock market, generating a surge of speculative money flows. A better outlook for both developed country demand and emerging markets eventually finds its way to the commodity complex. As a result, nearly all commodities (with the exception of Gold and Natural Gas) rallied last week. This week, we can expect futures to try to test 195 USc/lb at some point before coming down and then falling back to a 180-190 range.

Image source: The Daily Shot

23 January 2024

This week Arabica coffee futures rose 5.15 cents (2.86%) to end the second week of Index rebalancing at 185.15 USC/lb. There is no question that prices outperformed after rejecting the support level of 175. Strong non-commercial buying appears to indicate they want to go for 190 again. There is overall buying in the commodity complex due to positive signals from US jobs data. The H/K tightness is further supporting prices as new gradings are not rising and on some grading sessions the pass rates are barely above 50%. Let´s also not lose sight of the fact that the price of Robusta surged to new historic highs as Vietnam farmers delay deliveries of pre-sold coffee while Red Sea shipping attacks slow deliveries to Europe. The London market closed mid week at a new record high of $3,170.

16 January 2024

This week, coffee futures fell 2.4 cents from Friday to Friday to end the first week of Index rebalancing at 180 USC/lb. So far, over the COT period that included Monday and Tuesday of last week, Index sold a little more than 5000 lots. However, nearly all of that selling has been absorbed by Non Commercial traders looking to either exit their short arb position (Long Robusta, Short Arabica), or simply use the index selling to buy Arabica. The change in the Open Interest suggests that the former is more likely. I suggested a middle ground for this week, seeing prices erode down to 175 before finding support, so even my midline estimate was found to be too aggressive to the downside. Overall, I did not expect the short covering from speculators to be as strong as it was. This week, we have 1 more day of index rebalancing left before index selling dries up, which will hopefully put an end to this game-theory type analysis and I can return my focus for these reports to more relevant factors such as crop conditions and coffee demand. Ordinarily, the sudden stop of selling would result in a market correction to the upside once index selling ends. However, as many buyers already used the selling liquidity of the previous week to buy, I am going to double down on my expectations that the market will find itself around 175 by the end of the week, having overbought the week prior.

9 January 2024

This week, coffee futures basis the most active March contract fell 5.5 cents to finish at 182.80 USC/lb on Friday. Last week, I had focused on the upcoming Index rebalancing, which suggests 9000 lots of selling to be done starting Tuesday this week and continuing until Tuesday, Jan 16th. With the stipulation that the wider market all knows this selling is going to come, we should expect some pre-positioning to occur in anticipation of this event and for the market to fall back down into the 180-190 range. This is exactly what happened, and we now see ourselves well poised for the rebalancing sparking an additional selloff. Using the average 1.2 cents per 1000 lots of selling, it not unreasonable to see the rebalancing bring the market down to the low 170s or even breach 170. However, it is also possible that discretionary traders see the rebalancing as an opportunity to use the index liquidity to get long. In that case, we are likely to bounce off of 175 as the support level. Further tightness from Arabica’s cousin – Robusta could help support the argument for adding length in an Arabica market that is still not out of the woods in terms of ice certified stocks and spreads. Therefore, I am suggesting a middle ground for this week, seeing prices erode down to 175 before finding support.

4 January 2024

This week, coffee futures prices basis the most active March contract fell 4.2 cents over the holiday week to end the first day of the trading year at 190.15 USc/lb. Most of the price action occurred on the last trading day of the year, Dec 29th , when futures prices collapsed 9.7 cents over the course of the day. It seems that some profit taking had occurred among speculators who had held a long position. A pause in momentum buying as well as an absence of roaster buying due to the holidays may have contributed to the price reaction and the end of year collapse. This month, the main focus is on an annual event called the “Index Rebalancing”. The index, specifically the Bloomberg Commodity Index, (BCOM) is a passive commodity investor with a specific allocation or weighting in each commodity. This year, BCOM is increasing its allocation to coffee from 2.858% to 2.974% while at the same time coffee futures went up 19.9%. Therefore, my estimate is that the BCOM will have to sell around 9000 lots of coffee futures to rebalance its portfolio for 2024. As a proportion of total open interest across all commodities, this is the most amount of selling relative to the size of the market of any commodity this year (Natural Gas and Nickel will see the most buying). Most financial analysts can also make this same calculation with some googling and looking at price changes. Therefore, the wider market all knows this selling is going to come the 3rd week of January. As a result, we should expect some pre-positioning to occur in anticipation of this event. Therefore, my expectation for next week is for the market to fall back down into the 180-190 range.

19 December 2023

Last week, coffee futures prices continued their ascent, rallying 12.15 cents from Friday to Friday to finish at 189.3 USc/lb basis the most active March contract. I had expected last for prices to test the most recent resistance level of 185 cents/lb that, if broken, can send futures prices back to $2/lb. It seems I was 50% correct as the 185 USc/lb resistance was wholly broken but it seems prices found a in between resistance level of 190 USC/lb where significant profit taking from longs seemed to have emerged. The Arabica market seemed to have been supported strongly this week by its cousin, Robusta, which saw January futures rally 11.8% or 13.5 US cents /lb equivalent over the week. Dryness in Brazil’s main Robusta regions seemed to have been highlighted as the main concern. However, it must also be noted that current availability of Robusta in consuming countries is estimated to be the lowest in 10 years. Extremely low ending stocks in Vietnam as well as near record incorporation of Robusta in blends has contributed to the current tightness. In all, we expect the surprising increase in volatility over the last couple of weeks to calm down as futures trade in the 185-195 range.

12 December 2023

Last week, after a rather large briefing, I said that I expected the market to settle back down below 180 USc/lb as we move beyond the regrading storyline and focus once again on the cost to certify fresh physical coffee to refill the exchange stock pipeline. This was the case if we look at futures prices from a Friday to Friday perspective, when prices fell from 184 to 177 USc/lb. However, on a Monday to Monday basis, prices actually rose 4.7 cents to end the week at 184.1 USc/lb basis the nearest March contract. Not much has changed, which unfortunately means that the dire low certified stock story is not close to being resolved. On top of this, a new headline is starting to take over, which is that Brazil has had an exceptionally hot and dry spell for the last 6 weeks. This is critical for the northern Arabica regions like Cerrado, but also regions further east such as Espirito Santo and Bahia, which primarily grow Robusta. At the moment and given how early we are in crop development for Arabica, its too early to ascertain the damage, but it suffices to say that the story adds fuel to the fire. Therefore, this week we expect prices to test the most recent resistance level of 185 cents/lb that, if broken, can send futures prices back to $2/lb.

5 December 2023

Last week, I wrote that “we expect the inversion and consequently upward price pressure to continue this week, with futures likely to test the resistance level of 175 USc/lb this week the most likely outcome.” Last week feels like a century ago in terms of price action, as futures found their way blasting through the 175 USc/lb resistance and finished up 16.2 cents to close the week at 184.25 USc/lb basis the most active March contract. “The inversion,” or the premium of nearby futures contracts relative to farther ones due to a critically low exchange certified stock total continued to be the main driver. What I didn’t appreciate last week was how much the impact of a small rule change would have on prices last week. Several months ago, the ICE exchange published a change in the coffee futures rulebook, which stopped the practice of being able to decertify exchange stocks and offer them up as a new sample, a process called “regrading”. This (in my opinion toxic) loophole allowed certified stock owners to reset the clock on coffee that’s potentially much older than the exchange officially calculates so long as the cup remains free from “aged flavors”. The last day for regraded coffees to be accepted by the exchange was November 30th. There was a camp in the market who staunchly believed that the recent decrease in certified inventories was due to a scheme meant to take advantage of this last day of regrading and that as the deadline loomed, older coffee would appear to refill the pipeline, thereby weakening the spread and letting the market go lower. This storyline was prevalent enough to be featured in the main source for financial news, Bloomberg. As we approached Nov 30th and no significant amounts of older coffees appeared, it became suddenly clear to some market participants that perhaps these older exchange inventories were already sold. At a heavy discount to futures (trading at a negative differentials in most cases basis EXW), these older coffees had found a home with roasters especially as Brazilian differentials remained stubbornly high. Once it became clear that no new coffee was coming, the regrading camp panicked and were forced to liquidate their positions into a tighter spread environment and a surge of momentum buying. This week, we expect the market to settle back down below 180 USc/lb as we move beyond the regrading storyline and focus once again on the cost to certify fresh physical coffee to refill the exchange stock pipeline.

28 November 2023

This week, coffee futures basis the most active March contract fell 2.1 cents from Monday to Monday to begin the week at 169.05 USc/lb. Despite the US Thanksgiving holiday offering respite from the volatility of the market, most of the focus shifted back towards the delivery of the soon to expire December futures contract. Even though this only concerns participants looking to deliver or take delivery of ICE Certified stocks, the December/March spread has now widened to +10.65 as of Monday. This is the most inverted spread since November 1998, when Arabica faced a 4.7 million bag deficit year following a 9 million bag deficit two years prior due to a huge frost in Brazil in July 1994. If you’re putting the similarities together to the frost we faced 2 years prior in 2021, then I’m not alone. The differences between the two periods are that Brazilian production response this time around was much stronger, and a rapid shift towards higher usage of Robusta (partially due to immediately higher prices and partially due to changing consumer preferences in a high inflation environment) has freed up an expected 6.4 million bags of Arabica availability for the 23/24 crop. The issue is that, so far, the prices of this coffee on a differential basis is nowhere near levels where someone could buy the coffee and certify to the ICE exchange, thereby refilling the pipeline of coffee that forms the physical backbone of the Arabica futures contract. Therefore, we expect the inversion and consequently upward price pressure to continue this week, with futures likely to test the resistance level of 175 USc/lb this week the most likely outcome.

21 November 2023

This week, coffee futures basis the most active March contract fell 3.9 cents from Friday to Friday to end at 166.65 USC/lb. As of writing, however, it looks like Monday’s action is likely to reverse the weekly price move to unchanged or slightly higher on the week. The main driver of the market has continued to be increased volatility surrounding the upcoming delivery period of the December contracts brought on by the lowest exchange certified Arabica inventories since the 1990’s. The tightness in nearby supply, however, is offset by a clear market consensus of an Arabica surplus in 2024. Therefore, free-market economics would dictate that price changes need to occur in order to incentivize the accumulation of inventory in consuming countries as quickly as possible. This is being done through the severe inversion of the December-March contract and now an inversion of the March-May contract as well. On top of this, the higher futures prices are making differentials, or the premium (or discount) of specific coffee qualities to the futures contract, collapse to levels not seen since early 2020. However, at the moment, no coffees are offered cheap enough to be able to certify at the exchange in significant quantities. Therefore, the combination of spreads, futures prices and differentials need to do more work to allow this situation to occur.

14 November 2023

This week, coffee futures prices basis the now most active March contract rose 1.4 cents from Friday to Friday to end at 170.55 USc/lb. The behavior of the December-March spread (Z/H) dominated the price action this week as index and other passive investors rolled their positions from one contract to the next, allowing other participants the liquidity to get out or get into the spread. As a result, the spread moved from +1.75 cents to as high as +4.6 cents (inversion) on Thursday before collapsing Friday back to +3.95 cents. To review, this means that the premium of the nearby December contract is 3.95 cents over the March contract, showcasing the shortfall in supply for at least ICE certified Arabica and arguably Arabica in general in consuming countries. ICE certified stocks fell 57k bags this week to reach a new 25+ year low of 302k bags on Friday. With certifications down 145k bags or 33% over the past month, it becomes the job of the market to attract new coffee for certification by either paying producers through higher overall prices so that they reduce their differential, or by making the December-March spread so painful for an importer holding certifiable coffee so that they have no choice but to offer it to the exchange for grading. This week, we expect the spread to continue to tighten, but the relationship between December-March spread and flat price will weaken and so its possible that prices overall fall back to the bottom of the 165-175 range.

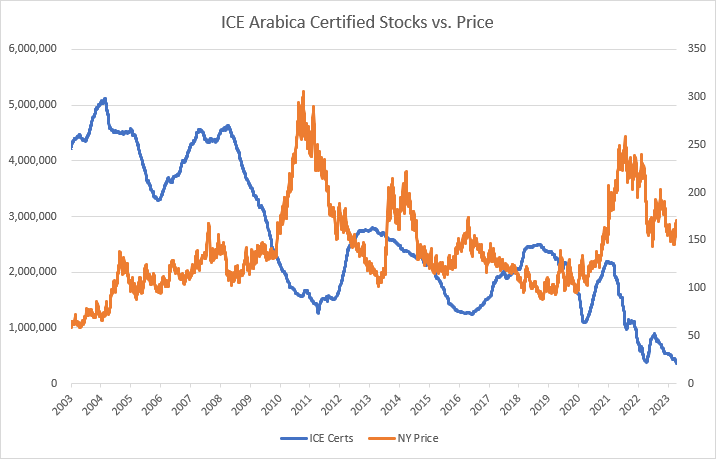

7 November 2023

This week, coffee futures prices basis the still most active December contract rose 9.95 cents from Friday to Friday to end at 170.9 USc/lb. The main impetus behind the rally has been continued tightness on the December/March spread. Adding fuel to the fire was the fact that ICE Arabica-certified stocks had now fallen below 400,000 bags last Friday and were down to 360,000 bags as of Friday. This is the lowest level of ICE Certified Stocks since the 1990s, beating out the lows set last year. The chart below shows futures prices vs. ICE Arabica-certified stocks since 2003, which can help explain why prices and also spreads have been so volatile lately.

Anyone holding a long position into the delivery period of the contract will receive physical coffee. If there is not enough coffee, futures prices (either just the front month contract or the across the curve) need to go to a level where it is profitable for someone holding physical coffee to bring it to the exchange for certification. Certain other contract quirks, such as having 700g weight jute bags, creates additional costs for the deliverer (for a full list of exchange rules, here’s the link). Moreover, higher costs of freight and a rising interest rate over the past 2 years have added to the cost of certification. Overall, our estimate depending on which origin the certified coffee is from and which port it is going to, coffee has to be bought between -10 and -17 FOB to break even for certification. Physical prices at origin are not there yet. Nevertheless, this week we expect the market to abate slightly as the index rolls their positions from December to March. Overall, it seems clear that a new range of 160-175 has been established for the moment.

31 October 2023

This week, coffee futures prices fell 4.3 cents from Friday to Friday to end at 160.95 USc/lb basis the most active December contract. Last week, I wrote about the impact of the nearby spread action on futures prices, and suggested that “the next support level of 165.25 seems to be holding, but if broken, could send futures soaring further to 175 USc/lb this week”. Indeed, by the time this report got distributed, we had broken the 165.25 resistance level and the market surged higher over the next three days to a high of 169.05. Then, mid-day Wednesday a major wave of selling emerged (with the line in the sand apparently drawn 5 cents below my announced resistance target) and the market fell back down in spectacular fashion back to a low of 160.95. The intense price action showed both the significant resistance at 170 and also showed that there were not a lot of buyers left in the market once prices started crumbling. This is a clear case of the market doing too much in too short of a time period. While we remain cautious regarding the December-March spread, there is still about a week left before Index (passive commodity investors) participants roll their positions into March. Once Index rolls out, liquidity in the spread decreases and volatility increases as we approach the December futures delivery period. It is at that point that we could expect increasing tightness and another attempt for the market to rally due to the low availability of cheap Arabica at destination. Until then, however, we would expect the market to stabilize this week, perhaps falling back to 155 USc/lb before new buyers emerge.

24 October 2023

This week, coffee futures basis the most active December contract rose 10.35 cents from Friday to Friday to end at 165.25 US cents/lb. I expected the market to retrace last week with the Brazilian Real appreciating back into its normal range, but was soundly defeated by the action of the December/March spread. The spread, or the difference in price between two futures months, rose from -0.25 cents last Friday to a peak of +2.15 USc/lb on Thursday. A spread going into positive numbers is an unnatural occurrence called an inversion (it’s unnatural because typically the difference in futures prices helps to cover the carry costs of coffee for the inventory holder). The December/March spread inverted quickly, violently, and outside the typical timelines of major spread trading, such as the index roll period or prior to the contract delivery period. To the market, a rapid inversion stipulates a shortage of coffee in the nearby contract. Indeed, stocks at destination ports have dwindled significantly this year and it has become clear that no additional coffee is coming to replenish ICE certified stocks yet (due to the physical price of coffee making it uneconomical to certify). A sudden implication of shortage is often accompanied by panicked short covering from speculative sectors, who have been heavily invested in the short side as of late. The panicked buying added momentum to the market, breaking it out of its recent trading range. The next support level of 165.25 seems to be holding, but if broken, could send futures soaring further to 175 USc/lb this week.

17 October 2023

This week, coffee futures rallied 8.85 cents from Friday to Friday to end at 154.9 USc/lb. As I wrote last week, we expected the Brazilian Real will to stabilize and the market to bounce back to 150 USc/lb. The Brazilian real outperformed my expectations, strengthening back down to near 5 from 5.20 the week before. Therefore, it is rational that the price action also outperformed my expectations. Most of the positive price action occurred on Friday when a strong breach of technical resistance at 150 USc/lb sent shorts in a bit of a panic, forcing them to buy back and sending prices higher. Indeed, short covering rallies become more likely if speculators are seen to be adding significant size below where the current market is trading. Over the last 2 weeks, speculators added 8,106 lots or 49% of their short position below 150 USc/lb. With that much investment underwater, the risk of short covering increases the higher we go from Friday’s level. However, on the opposite side is that most origins still have coffee to sell on hand. Lower levels of commercialization from Central America and Brazil are likely to continue to weigh on the market. A price level where a farmer may not have wanted to fix 3 months ago might look great now that Brazil is likely set up to produce a massive 24/25 Arabica crop. In all, we expect the market to retrace a little bit this week and trade again in the 145-155 range.

10 October 2023

This week, coffee futures fell 3.05 cents from Friday to Friday to finish the week at 146.05 US cents/lb. We are now past the weather market in Brazil with another beautiful flowering appearing over the weekend. Most of the price action can be explained by the sudden breakdown in the Brazilian Real. The Brazilian currency went from 5.03 on Monday to 5.15 on Friday touching as high as 5.20. Without futures prices changing, farmers in Brazil (who see everything on their farm going well) all of a sudden get more Reais for selling their coffee this week. As a matter of fact, futures actually outperformed the devaluation of the Real slightly, which is an indicator that futures are remaining resilient and roaster buying emerges near the low of the 145-155 range. The reasons for the sudden devaluation are complex but have to do more with US dollar strength and China’s economy disappointing than with Brazil internally. Therefore, we believe that the Real will likely stabilize at 5.20 and the market will likely bounce this week back to 150 USc/lb.

3 October 2023

Last week, coffee futures basis the most active December contract fell 2.65 cents from Friday to Friday to end at 146.15 USC/lb. On the previous report I discussed the return of rains in Brazil as the main factor, noting that any misses in precipitation totals can get market participants nervous again. As such, we expected prices to remain volatile to the upside if things don’t go perfectly, but test the bottom of the recent range if 145 if they do. The rains performed as expected, which relieved dryness and stress on newly flowered trees and will likely stimulate a second, larger flowering this week to fix the rest of the crop. We now believe that any premium regarding weather has now been removed from the market and we are seeing a normalization period of lower volatility. Coming into the 4th quarter, roaster fixations (purchases of futures) come head to head with farmer sales (sale of futures). As the northern hemisphere winter is historically the season with the most demand and roasters are well noted to be more hand-to-mouth with their coverage this year, we can expect more fixation to come than usual, especially if we are to breach below the current range (145). On the sales side, farmers, especially in Brazil, are finding themselves with increasing amounts of coffee to sell. We believe that at 160 or better, farmers will be eager sellers. Therefore, this week we can expect a return of the 145-155 range for the market.

26 September 2023

This week, coffee prices basis the most active December contract collapsed 12.15 cents from Monday to Monday, ending the day at 148.80 US cents/lb. Much of the last 3 reports discussed the early flowering in Brazil and its repercussions given the lack of timely return of rainfall to fixation. Last week, the market finally got a reprieve as weather forecasts started to show rain in Brazil starting on September 28th. So far in Brazil growing areas it has been excessively hot and dry, which stresses the flowers on the trees. However, most farmers remain optimistic about fixations if rains do in fact return by the end of the month. With just a few days to go, getting confidence in the rainfall became increasingly important and the market started to follow weather forecasts more than actuals. As soon as rain came back into the forecast window, the panic of the rally subsided and the market fell back into its 145-155 range it has been trading in recent months. However it is important to note that the rains are on the computer screen and have not fallen on the ground yet. Therefore, any misses in precipitation totals can get market participants nervous again and as such we expect prices to remain volatile to the upside if things don’t go perfectly, but test the bottom of the recent range if 145 if they do.

18 September 2023

This week, coffee futures basis the most active December contract rallied 6.3 cents from Friday to Friday to end at 159.15 US cents/lb. Last week, we had expected the market to follow the weather in Brazil closely and trade off changes in the weather forecast, as trees in Brazil had flowered and now are waiting for follow up rains for fixation. Our focus on the Brazilian flowering has gotten a bit more urgency this week as last Friday’s drizzle offered minimal improvement in soil moisture. The next 10 days or so look very hot with temps well into the mid 30’s C by late this week. This heat and dryness increases stress on coffee trees and calls into question fixation rates as many areas are looking at over 3 weeks of dryness assuming rain arrives at the end of the month. The question the market must grapple with: If rain just underperformed weather model estimates inside 24 hours, are you comfortable believing rainfall forecasts over 10 days from now? As a result this week should see continued futures price volatility as weather forecasts become center focus, and prices approach critical resistance levels of 165 USc/lb.

12 September 2023

This week, coffee futures prices basis the most active December contract fell 3.25 cents from Friday to Friday to end at 148.65 USc/lb. The market continues to bounce listlessly between the clear resistance at 155 USc/lb and firm roaster support below 150 USc/lb. From a seasonality perspective, September is the most negative month for coffee futures, with a 2/3 chance over the last 20 years that the market finishes the month lower, with average prices falling more than 3%. The explanation for this seasonality is typically that September is the end of harvesting season in Brazil and the start of the flowering and fixation season for the next crop. Farmers, having finished their harvesting activities, look at their trees, see good productivity for the next year, get a little panicked about their coffee inventories, and decide to sell. However, the main highlight here is seeing good productivity. Over last weekend in Brazil’s major producing area, we saw the first widespread flowering event. This event now needs flowers to convert to cherries and become coffee, and for that follow up rains are needed. At the moment, there are no meaningful rains in the forecast up to 15 days. This is about the limit that the tree can handle without rain before flowers fall to the ground and an abortion event occurs. Seasonally, rains in Brazil pick up at the end of September so it is probable all will be fine. But the producer is waiting for this to occur before having confidence in selling. This week, we expect the market to follow the weather in Brazil closely and trade off changes in the weather forecast.

30 August 2023

This week, coffee futures prices basis the most active December contract, prices rose 2.35 cents from Friday to Friday to end at 153.15 USc/lb. A clear upward trend in prices has been observed throughout the week as weather in Brazil takes center stage. Over the weekend, significant rainfall totals have reached the main producing regions of Sul De Minas, Mogiana and Cerrado. We believe that these rains are sufficient to wake up the trees and induce the first flowering for the 24/25 crop cycle. In order to keep the flowers on the trees and turn them into cherries, however, follow up rains are needed. At the moment, we are looking at a dry forecast once these rains pass, indicating a possibility that excessive dry weather will force flowers to abort, resulting in lost production for the season. This weather event occurs at the same time as the Non Commercial position has extended their negative views on the market. At -31,318 lots or $1.8 billion invested on the short side amongst speculators, this is the highest short position since January. As the market tried to break technical resistance of 155 last week, there was clear defensive selling from speculators in order to keep the market from breaking out. All of these factors create a possibly volatile situation developing in coffee over the next 2 weeks (perhaps similar to what we have seen in other markets such as Sugar recently). Therefore, our expectation is for the market to break technical resistance of 155 this week and test 165 USc/lb unless forecasts for Brazilian rainfall begin showing follow up rains in the 10-15 day forecast window.

22 August 2023

Last week, coffee prices basis the most active December futures contract fell 2.6 cents from Friday to Friday to end at 150 USc/lb. The 10 year average futures price for Arabica futures is 145 and the 15 year average is 155 USc/lb, suggesting that we are now approaching long term price means and a should expect a significant level of support in between these levels as “reversion to the mean” trades are turned off. Last week, I wrote that “The speed at which (negative momentum taking prices back down to the January lows of 144 USc/lb) depends on the amount of buying pressure that will come from roasters around the psychological support level of 150 USc/lb.” Indeed with the September contract expiry close in sight, roasters saw a broader break below 150 as an opportunity to fix futures forward. The emergence of strong support below lifted futures higher on Thursday after a low of 147.45 was set in. This week, attention turns back towards weather in Brazil as the first spring rains are expected hit the major Arabica producing regions this weekend and into next week. Right now, the rains do have the potential to wake up the trees from a state of dormancy and induce a first flowering event. Once this occurs, follow up rains become critically important to fix the flowers to the trees and ultimately produce coffee cherries. Therefore, we should expect to enter a period of higher volatility and unpredictability due to weather forecasts this week.

15 August 2023

This week, coffee prices basis the now most active December futures contract collapsed 10.85 cents from Monday to Monday to end at 152.6 US cents/lb. While a steady erosion in price levels occurred throughout the week, it was the price action on Thursday and Monday that were the most notable. On Thursday, prices breached the critical support level of 160 US cents/lb on the back of weakness stemming from the roll from September futures to December. Passive money managers, called Index, hold long positions across a broad range of commodities in the most active contract. Per a previously agreed schedule, these participants roll their positions from one month to the next, by selling their position in the front month and buying the back month. This aspect of essentially selling the spread often attracts additional sellers on the momentum side. In a typical roll period, we often expect negative pressure to come from rolling periods specifically for this reason. However, for this role many market participants felt that pressure could actually be positive due to the low ICE certified stock levels seen on the market and due to the ongoing disparity between physical prices and futures prices (thereby making it extremely uneconomic to refill ICE certified stocks). These participants seemed to have become exhausted in their view on Monday and were forced to exit their spread positions, forcing additional negative pressure on a market that had already seen a technical breach, a weaker Brazilian Real, and pent up farmer selling over the weekend. As a result, prices slid from 157.7 to 152.60 throughout the day. The break of 155 marks a technical breakdown in prices, suggesting negative momentum taking prices back down to the January lows of 144 USc/lb. The speed at which this occurs depends on the amount of buying pressure that will come from roasters around the psychological support level of 150 USc/lb.

1 August 2023

This week, coffee prices basis the most active September contract fell 3.95 cents from Friday to Friday to end at 157.9 USc/lb. Overall, the pattern continues in a choppy trade range of 155-165 as clear support from Roaster buying can be seen near the bottom and stronger origin selling seems to appear at the top. At the moment, we have good confidence now that the Brazilian winter season will not have any threatening cold, moving the weather risk squarely to the flowering for the 24/25 crop. On the physical trading side, things seemed to have subsided but overall differentials have reached a near-term bottom it seems and lower prices are showing some resilience on the differentials side. Peru is the major driver for Arabica offerings at the moment, while peak Brazil flow is likely to only come next month. From the Brazilian farmer’s perspective, they are still holding a great deal of stock at the farm that they need to sell. However, given the stronger level of the Brazilian Real, they are now getting less value for their coffee that they sell in USD, prompting them to hold more unless futures prices rise. This week, we expect prices to rise to the top of the recent range near 165 before meeting some resistance.

25 July 2023

This week, coffee futures prices basis the most active September contract rose 1.05 cents from Friday to Friday to end at 161.85 USc/lb. Last week, I wrote that “we expect prices to continue to oscillate, although there is some opportunity for a short covering rally to bring us closer to the top of the range at 165”. An exhaustion of sellers seemed to have occurred late last week as the market bounced off of resistance levels at 155 for the 3rd time in 3 weeks. From there, the market climbed steadily on Thursday and Friday that coincided with a rise in Sugar prices as well. The thing that ties coffee and sugar together in commodity markets is that Brazil is by far the #1 producing country for both commodities. Therefore, any impacts on investment in Brazil or oscillations in the Brazilian Real exchange rate should affect both markets. Last week, we saw the Real appreciate from 4.85 to 4.77, which is the lowest level in more than a year. In a commonly overlooked economic print, Brazilian foreign exchange flows reported $3.876 US billion of inflows into the country compared to a forecast of $1.948 US Billion. Foreign asset flows into Brazil may be a play to take advantage of Brazil’s high interest rates (relative to inflation the interest rates are still very high), or they may be a move to invest more in Brazilian economy as expectations for US dollar strength weaken. Whenever these types of asset flows occur, you often also see speculative flows into commodities that have a high correlation to the BRL. Coffee and Sugar are on the top of that list, so it is possible that these commodity contracts sometimes act as a proxy for BRL strength. This week, we expect prices to break out of the 165 range as momentum buying contributes to short investors throwing in the towel after the market was not able to break down below 155 three times.

18 July 2023

This week, coffee futures prices basis the most active September contract finished virtually unchanged, down .10 cents to 160.8 USc/lb. As I wrote last week, “we expect the same pattern of 155-165 to continue unless colder weather materializes on the Brazil forecasts. Early in the week it seemed that the support at 155 held up as roaster buying helped to buoy prices in an otherwise light trading environment. Weather in Brazil remains mild and now there is maybe one week left on the winter season’s forecasting schedule to see any cold materialize. With the winter season behind us, attention in Brazil starts to turn towards expectations for rainfall. Typically, rainfall comes to Brazil’s Arabica regions in September. If rain comes too early, the crop runs a risk of a prolonged dry spell causing flowerings to abort on the trees, losing that year’s production. Once the rain comes, it is important to provide some period of sunshine for the flowers to open and then follow up rains are required to ensure flowers fix into coffee cherries. The delicate balance is what farmers are looking for to ensure that the 24/25 crop comes in strong. If it does, farmers understand that they are sitting on a massive amount of coffee. With prices in Brazil still well above costs of production, they are likely to begin discounting prices and lowering differentials in order to win back market share from Central American and Peruvian coffees. This week, we expect prices to continue to oscillate, although there is some opportunity for a short covering rally to bring us closer to the top of the range at 165.

11 July 2023

Last week, coffee futures prices basis the most active September contract fell 0.7 cents from Friday to Friday to end at 160.9 USc/lb. As I wrote last week, “we expect the market to continue sideways with significant support emerging around 155 and resistance above 165 cents/lb.” This is exactly what occurred as the high of the week was 163.9 and the low was 155.8. As we move further and further in the Brazilian harvest, producers face increasing pressure to sell their coffees. On the other hand, roasters also have whittled down their inventory due to the high cost of capital and were waiting for the large Brazilian harvest to bring prices down to where they want. Thus, a game of chicken is now being played with neither side blinking at the moment. Unfortunately, for the time being it is the Colombian and Central American producers that are left paying the price for this standoff as these origin do not have the carrying capability of Brazil and must bring prices down to where their coffee can be commercialized. This week, we expect the same pattern of 155-165 to continue unless colder weather materializes on the Brazil forecasts.

4 July 2023

Last week, coffee futures basis the most active September contract fell 5.85 cents from Friday to Friday to end the week at 159 cents per lb. As written last week, we expected negative momentum to try to push prices lower to below 160 before finding some roaster buying support in the mid 150’s. This is exactly what happened and now support emerges as the market enters a new lower level. Week-on-week not much has changed as the Brazilian harvest is progressing well, and prices at origin as a function of the premium to the futures price continue to weaken. The weakness is driven more by demand reduction from the side of the roasters, who continue to favor minimalized pipelines due to the elevated cost of capital. Macroeconomic forces also saw a recovery in equities last week, potentially shifting some flows out of the commodity complex. This week, we expect the market to continue sideways with significant support emerging around 155 and resistance above 165 cents/lb. The Robusta market bears watching this week, as the delivery of the July contract will be very telling in gauging nearby demand, and price action will likely have a more significant impact on Arabica than usual.

27 June 2023

Last week, coffee prices basis the most active September futures contract collapsed 15.90 cents, falling to 164.85 as of Friday. While we believed that prices would see some support at 180 due to the coming up expiry of the July contract, it seems the opposite has occurred. The spread between July and September futures went from 4.15 cent inversion to a -0.25 carry as of Wednesday. The sudden weakness in the nearby futures contract just prior to the beginning of the delivery period can be seen as an extremely negative indicator for nearby demand. With differentials at origin, specifically Colombia, continuing to collapse there seems to be less and less interest to take ownership of ICE certified inventory. Falling differentials in a falling market is another very negative indicator for nearby roaster demand. Colombian differentials are now trading at the lowest levels seen since 2018, and clearly are working to regain market share with roaster blends without finding many buyers at the moment. Weather has provided an additional factor for the selloff. Normally the peak season of fear for Brazilian frost is the beginning of July. Last week, all weather models forecasting weather for that time period came in warmer, eliminating some risk premium built in for disruptively cold weather. Finally, a general sell off in commodities markets occurred last week on the back of persistently high inflation readings, especially in the UK and EU. Strong inflationary pressure continues to favor higher interest rates and therefore leads to further reductions in inventories due to higher cost of capital. This week, we expect negative momentum to try to push prices lower to below 160 before finding some roaster buying support in the mid-150s.

20 June 2023

This week coffee futures basis the most actively traded September contract fell 5.9 cents from Friday to Friday to end at 180.75 US cents/lb. The main driver behind the lower prices was easing of pressure on the nearby July/September spread which saw some roaster panic last week with fixations needing to come through before the contract expires (for those not looking to deliver or take delivery of ICE certified stocks). Also, weather in Brazil became more mild as some limited rains hit the region, but nothing that is tremendously disruptive to the harvest. Supportive to prices has been Arabica’s cousin - Robusta – which saw coffee futures break 2008 and 2011 highs as the July Robusta contract broke $2800 USD/MT (127 USC/lb). With the difference between Arabica and Robusta prices staying very high for more than a year, a massive amount of demand swing to Robusta out of low-grade Arabica and led to a shortage of Robusta worldwide. We see possible relief in the future for Robusta as well, but it, just like Arabica needs to come from Brazil once the harvest is completed. Next week, prices are likely to remain supported around 180 USc/lb as we approach July notice day on Thursday.

13 June 2023

Last week, coffee futures rallied 8.95 cents from Friday to Friday to end at 186.65 US cents/lb basis now the most active September contract. As I wrote last week, “we expect there to be some upward pressure on futures coming from the roll from July to September futures. In the last roll period, roasters were caught needing to fix coffee futures before the start of delivery period, resulting in an imbalance of buyers and sellers at that moment, lifting futures and the nearby spread higher and initiating further momentum buying.” Markets are quite unpredictable as there are lots of outside variables that can influence investor behavior and positioning. Therefore, it's nice to step back and take credit for a correct prediction. The only other thing I would add from last week is that weather events added some fuel to the fire last week. First, expectations for some rainy weather in Brazil got the market spooked as rain disrupts harvesting and can lead to quality issues in the world’s largest coffee producer. Second, the official declaration of El Nino led to some speculative buying across the agricultural sector. Overall, we do not expect a moderate El Nino to have significant downside impact on coffee production – in fact, impacts are likely to be beneficial. A severe El Nino can increase dryness risk in Vietnam, Central America and India, but tends to affect Robusta production more than Arabica. Therefore, this week, we expect futures to pare back a little and find some support around 180 US cents/lb as we approach the delivery period for July futures and assuming the risk of unseasonable rains in Brazil does not increase.

6 June 2023

Last week, coffee futures prices fell 1.3 cents basis the most active July contract to finish the week at 180.3 US cents/lb. Prices moved down easily in the early part of the week, buoyed by positive sentiment regarding the avoidance of US government debt default shifting money flows away from the commodity complex and into equities. Weather also remained supportive as nearby forecasts of cooler temperatures and rains in Brazil came in both warmer and drier – conditions that are optimal for speeding up Brazil’s Arabica harvest. Futures moved down to a low of 175.9 on Wednesday when roaster buying supported the market higher. On the first of June newly allocated capital helped spur momentum buyers forward, lifting prices back up to almost 185 before new resistance kicked in Friday leading us back almost to where we started the week. The volatile but sideways price action is indicative of overall market sentiment. On one hand, the Brazilian harvest is well underway and demand expectations (particularly in the US) continue to be weak, leading to a conclusion that prices need to head lower. On the other hand, we are still in an inverted spread environment with no possibility of delivery of ICE-certified stocks to calm down the nearby tightness and 8 more weeks of Brazilian winter to get through. This week, we expect there to be some upward pressure on futures coming from the roll from July to September futures. In the last roll period, roasters were caught needing to fix coffee futures before the start of delivery period, resulting in an imbalance of buyers and sellers at that moment, lifting futures and the nearby spread higher and initiating further momentum buying.

30 May 2023

This week, coffee futures prices basis the most active July contract fell 10.4 cents from Friday to Friday to end at 181.6 USc/lb. Prices attempted to edge higher early in the week toward 195 cents/lb and were unable to break that technical resistance barrier and settling back toward the high 180’s. However, on Thursday, positive macroeconomic data led by surprising Q1 GDP print for the US led to an overall selloff in the commodity complex, forcing momentum signals for coffee to turn from a buy to a sell. A stronger economic growth print combined good US jobs data can give more ammo for the US Federal reserve to combat inflation by lifting interest rates higher. Higher relative interest rates mean a stronger US dollar, which means a weaker Brazilian Real, which means weaker coffee market as we are approaching peak selling season for Arabica. Weather also played a bit of a dynamic into the selloff as any news of cold in Brazil melted into an otherwise annoying rain event that can be disruptive to harvesting activities but not much else. This week, the market is looking to test a key support level of 180 which if broken can see momentum based selling down to 170 USc/lb, where there is likely to be support.

23 May 2023

This week, coffee futures prices basis the most active July contract rallied 6.45 cents from Friday to Friday to end at 189.3 US/lb. Most of the price action occurred on Monday when the market rallied from 183 to a high of 193 on the back of a friendly report showing speculators not as heavily invested in the coffee market. The weekly commitment of traders report allows us to see the level of investment that each participant type has, and last week it showed that speculator selling despite little price change. This means under the right conditions, specs have more available capital to redeploy at the market, potentially bringing it higher. After the market settled down during the mid-week an additional set of buying was brought on by a forecast of cold weather in Brazil. While we see no potential for frost in the coming 10 days for Brazilian coffee, the forecast does in fact help to wake up the market to the fact that we are approaching the risky season of Brazilian winter. This week, we expect the market to find resistance above 190 and 195 provided the weather in Brazil remains benign.

16 May 2023

This week, coffee futures basis the most active July contract fell 5.2 cents from Friday to Friday to end at 182.85 US cents/lb. The main driver behind the price action has been a selloff in coffee’s sister futures market: Robusta. High demand for Robusta, a cheaper alternative gaining traction with cost conscious consumers worldwide, has driven futures prices approach $2,500 USD/MT or 113.4 USC/lb. This is a level not seen since 2011, when Arabica futures prices were closer to $3/lb. On Thursday, Robusta futures briefly touched this historic $2,500 USD/MT level before a failure to break out resulted in longs taking profits, and prices sold off 3.6% on the day. Arabica futures followed, getting to a low of 182 on Thursday and approaching a critical support point of 180 USc/lb on Friday. However, late Friday action saw new speculative flows into the coffee complex, lifting prices well clear of the critical support level. This week, upward momentum could stimulate prices to retrace back to 190 especially if Robusta is finally able to break the 2500 USD/MT price level. A settle below 180 USc/lb is required to initiate more momentum selling, which would bring prices down to 170.

9 May 2023

This week, coffee futures prices basis the most active July contract rose 2.1 cents to finish the week at 188.05 US cents/lb. After a lackluster week that saw significant buy-side support at 185, a key technical level for momentum traders, the market broke down on Thursday to reach a low of 181.1. This seemed as a clear sign of a technical breakdown in the coffee market, which should have initiated some reversal of momentum long positions. However, on Friday, a friendly macroeconomic environment powered by surprisingly resilient US jobs data sent coffee futures sharply higher with a 5+ cent rally. The overall lack of direction in the market highlights both an illiquid trading environment and an uneasy state of affairs as we slowly progress to the peak of Brazilian Arabica harvest. Overall, we see harvesting at 20% completed for Arabica in Brazil, which is supported by dry weather conditions. Differentials across all origins are continuing to ease, although none are at the levels yet where it would be economical for importers to refill ICE Certified inventories. This week, we see the market continuing to test the 180-185 USc/lb threshold that should initiate momentum selling and begin to test support at 175. However, renewed interest in commodity markets due to sticky inflation as well as tight nearby stock conditions mean that we cannot rule out a surprise rally above 190.

2 May 2023

Last week, coffee futures prices basis the most active July contract fell 5.5 cents from Friday to Friday to end at 185.95 US cents/lb. The main driver behind the price action has been heavy producer fixations throughout the week. In fact over the week from Tuesday to Tuesday, prices fell 14.85 cents but speculators sold only 408 lots on a net basis. A typical price decline of 12-15 cents implies 8,500 lots of speculative liquidation based on the last 10 events. Specs selling 8,000 lots less than expected shows the entrenched nature of speculative positioning, but also the risk to the downside if the new longs were to capitulate. We believe that this could occur if coffee were to settle solidly below 185 cents/lb, where current momentum signals suggest long liquidation. On the other hand, the fact that almost no liquidation occurred in the first 15 cents of the move from 2023 highs suggests perhaps that the spec views are not shaken by short term market corrections. Indeed, looking at outside markets, the soft commodity complex is seeing increasing money flows. With Arabica stocks at destinations dwindling and us beginning to approach Brazilian winter, it may be that the pullback is temporary before prices push to new highs. Nevertheless, this week we expect prices to be heavily supported at 185 and push down to 175 if the 185 level is breached.

25 April 2023

This week, coffee prices fell 0.05 cents/lb from Friday to Friday to end at 191.45 basis the most active July contract. The weekly price action hides the volatility, which saw prices peak at 203.05 on Tuesday before a massive collapse on Thursday took prices back down from above $2/lb down to 194. Most of the price action corresponded with the action on the front month May-July spread, which continued its inversion from 1.95 cents/lb on Friday to a high of 2.4 cents on Wednesday before easing off just ahead of the May first notice day on Friday. Now that we are past first notice day, the importance of the May-July spread is only important to participants staying in the market to either take delivery of or deliver ICE certified inventory. Before this, anyone who does not want to participate ICE certified stock delivery has to be out of their May position by closing it out or rolling it to July. If you have a short position in the May contract, the effect of the roll makes you lose money with a higher inversion as the further out contract is valued lower than the nearby. With the first notice day being effectively the stop date for most participants to be out of their position, this provided a natural congestion period for panicked shorts to have to fix or roll. Combined by the strong technical price action and heavy momentum buying these factors caused the rapid surge in prices above the psychological $2 threshold before getting stopped just before the next supportive momentum buy level of $2.05. This week, we expect volatility to ease and prices to test the support level at 190 and then 185.

18 April 2023

This week, coffee prices rallied 9.8 cents from Friday to Friday to end at 191.50 basis the nearby July contract. Last week, I had mentioned to expect technical resistance at 185 that if broken can take prices easily to 195. The day that I wrote this piece last week saw a clear buying campaign that saw prices go from 180.70 on Monday’s close to 188.45 to finish Tuesday. The main driver for the buying came from the speculative side, whereby Non Commercials bought 11,249 lots on the week to give the biggest exposure on the long side since we fell from $2/lb in October. As expected, resistance on the short side was not found between 185 and 195 and we’re quickly finding the market trying to make a run at the $2/lb target. So far, that has not been broken as significant origin selling has appeared above 195 to suppress the speculative buying. Nevertheless, all signs point to a clear allocation of risk towards coffee, which is typically a buying campaign of 2-3 weeks until positions pull back. The potential reasons for the buying has been cited as the nearby tightness in the May/July spread, and the low availability of ICE certified stocks. As we are still 4 months away from being able to commercialize the very healthy looking 23/24 crop in Brazil, Arabica stocks remain tight. Furthermore, additional buying may be coming into the agricultural sector as global weather forecasting models are firmly turning toward El Nino forecast and perhaps even a Super-Nino phenomenon for 2024. Lastly, potential strength of the Brazilian real may provide some incentive for speculators to enter markets known to have strong negative correlations with the Real (namely Sugar and Coffee) as a proxy for trading Real strength. All in all, we expect the speculative buying campaign in coffee to continue this week, with support appearing between 205 and 210 if the psychological $2 mark is broken.

11 April 2023

This week saw coffee prices rally 13.1 cents from Friday to Friday to end at 183.60 cents/lb basis the May contract. As we approach the expiry of the May contract, much of the focus is shifting towards the front spread and the potential interest in market participants to receive ICE-certified inventories. Over the week the degree of inversion in the front spread went from 0.8 cents/lb to 1.9 cents/lb highlighting nearby tightness in the market. An inversion itself signifies shortage because it penalizes the holder of coffee by making them pay when they roll their futures hedges over to the next month. Over the week, the cost to roll a container of coffee from the May to July contract has increased from $338 to $804. In effect, this doubly penalizes the holder of inventory as they also have to pay storage fees at the warehouse where the coffee is held, or otherwise own the warehouse and pay for its upkeep (in a normal market environment called “carry”, the rolling of futures hedges partially or fully subsidises the warehouse cost). In a steeper inversion, the effect to outside market participants signifies that coffee is in high demand to warrant such a premium in the nearby futures contract, resulting in a flood of speculative buy interest. This week, we expect prices to see resistance around 185 that if broken can take prices to the next resistance level of 195.

4 April 2023

This week, coffee futures basis the most active May contract fell 0.65 cents from Monday to Monday to end at 176.25 US cents/lb. Price action was generally negative until Monday, when prices rallied 5.75 cents on the back of friendly macroeconomic sentiment. Overall, sentiment improved this week as bank failure news subsided. The main impetus for Monday’s rally has been a decision by OPEC to cut crude oil production by 1.66 million barrels per day in what is seen as an effort to combat lower prices. As a result of the expected cut, Crude futures jumped, finishing up 6% on the day. Coffee followed, and in the early morning found itself once again breaching above the 175 cents/lb threshold. This initiated some additional buying from momentum and technical analysis traders, as the market was able to stabilize back into the 185-175 range after failing through 175 last Tuesday. With last week’s price action all but erased, the market again has to break 175 to reinitiate selling, with support likely to come at 170. On the upside, renewed inflation fears (due to persistently higher crude oil prices) could drive more near term buying into the commodity markets, leaving coffee to potentially test 185 cents/lb before finding support again.

28 March 2023