All the Rest, Resources for Roasters

Monday, April 24, 2023

What's Happening in Brazil?

Farmers in Espirito Santo state are feeling blessed this year as the 23/24 Brazil Robusta crop begins harvest 10 days earlier than last year due to superb weather conditions. Overall, we expect the Brazil Conillon (Robusta) crop to come in at an all-time record of 24 million bags for the 23/24 season. This represents an increase of 3.7% from last year’s record of 23 million bags.

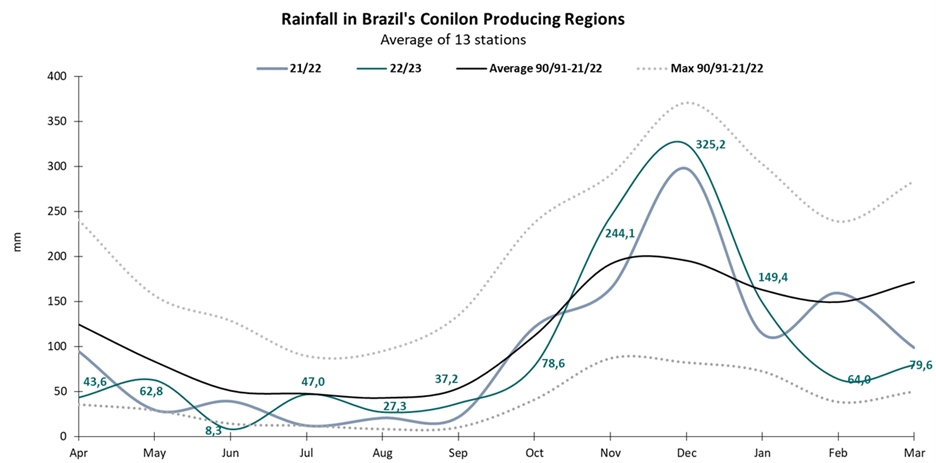

Excellent weather has been the major driver for higher yields for the upcoming crop with the cumulative rainfall for the most critical cherry filling period of November and December coming in well above normal at 244 and 325 mm, respectively. Even with the majority of Conillon farms having access to irrigation, a wetter than normal rainy season helps not only to regain root-level soil moisture but also helps to replenish reservoir levels available for irrigation. Typically, a wetter outlook during the Brazilian summer can result in messy harvesting conditions in the fall, but this has not occurred. February and March rainfall for the Conillon regions were much lower than normal, which allows plenty of sunshine hours for cherries to ripen and mature. As a result, screen sizes are expected to be higher this year and, barring any major rain events into the end of the rainy season, Conillon quality at harvest is expected to be good.

Our expectations are for the internal availability of Robusta to peak in June as pressures from Brazilian industry to buy Conillon for internal usage subsides. Our overall outlook for Brazilian consumption is a 2% growth following 3 consecutive crop cycles of flat consumption at 21 million bags. Overall, we remain more optimistic in our consumption outlook than Associação Brasileira da Indústria de Café (ABIC), which had indicated a contraction of 1% for the 22/23 season.

We believe that the general resiliency of Brazilian economic conditions and a healthy labor market will continue to support overall demand. This demand is driven by roaster blends that continue to utilize the lowest cost, highest percentage of Conillon. Therefore, we believe that only 5-8 million bags of Conillons will be made available for export (of which 3,600 is stable soluble export flow). This will depend on how competitive Conillon differentials become for the global market.

Overall, we believe that the job of the market is to incentivize higher Robusta exports out of Brazil to help refill declining pipelines in the US and Europe. However, with importing country demand being quite tenuous it is possible that the largest amount of pressure falls on the Brazilian farmer, who is already holding higher stock levels from the 22/23 crop and is now faced with another round of record production. This suggests a negative outlook on Conillon differentials as we approach the peak of harvest.

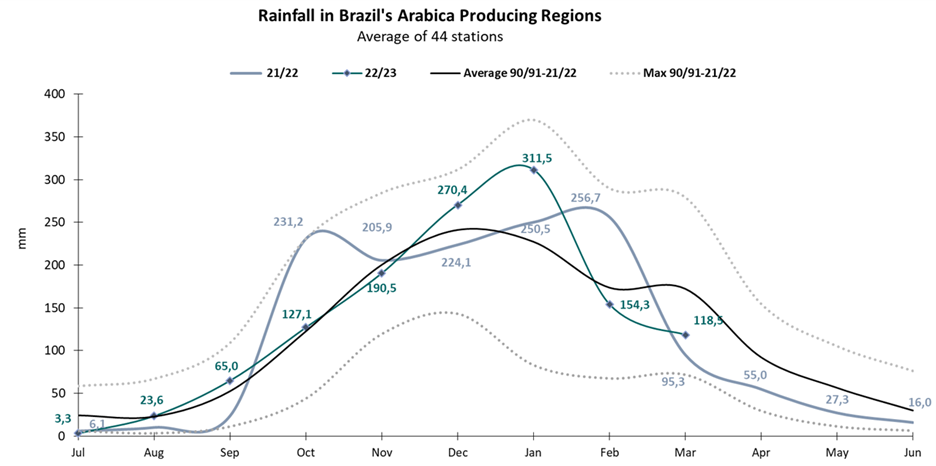

On the Arabica side, we are still 3 months away from the harvesting period. Rainfall for the 23/24 crop cycle has been ideal, with steadily increasing monthly totals since September that have allowed flowerings to fix and development to begin. As of the first week of March, Arabica areas on a production-weighted perspective received 1,600mm of rain for the season, which is viewed as the annual need for the plant. While some local news circulated regarding flooding in areas, we believe that excess rain during the peak of the rainy season simply helped to replenish soil moisture and reservoir levels for farmers. Furthermore, the heavy clay-based soil structures in Sul de Minas and the deep root system of the Arabica tree actually benefits from dissolution of fertilizer deeper into the ground – a process that can only occur after excess rainfall. Issues with excessive rainfall typically only arise from an active rainy pattern from April onwards. Currently, we see the weather pattern turning drier for the Arabica regions. This should support cherry maturation and ripening.

Despite an increase in fertilizer prices of 20% YoY, we believe that the farmer still commands a significant premium in the market to operate his/her business profitably and therefore we see no reduction of inputs for 23/24 crop. Our expectation for the 23/24 crop is 43 million bags, which is an increase of 2 million bags from our December estimate but still well away from our 20/21 record crop of 51 million bags. This suggests 35-38 million bags of Arabica will likely become available for export, depending on market conditions. While this is a sizable increase in availability from the previous years, our assessment of farmer behavior is that they will likely keep coffee for longer than would otherwise be expected or wait for position production to be confirmed and the cold season to pass without incident before selling the excess. As summarized by the purchasing manager of Cooxupe, “the producer was very insecure about what to do, as he lost reference to his productivity in recent years, when crops were greatly affected by climatic adversities, drought and frost. All of this makes them very cautious when negotiating coffee, especially since there was little to be sold.” As a result, we see the Arabica situation remaining particularly tight for Brazilian Arabicas in the export market in Q2 2023.

Ilya Byzov is a Quantitative Trader at Sucafina. He is based in our Brooklyn, New York office.