Resources for Roasters

Monday, October 23, 2023

Understanding Differentials and the NY Market

Coffee differentials, or ‘basis’ as it is called in most other commodity markets, are an important feature of coffee trading. In a typical commercial coffee contract, a buyer of coffee has a short futures contract fixation to counteract the risk of underlying coffee contract prices falling, but the differential (“diff”, for short) itself is never protected. In our last article, we covered what a differential is and how it impacts the price of coffee. In this article, we aim to explain some of the most referenced differential categories in Arabica and explore their relationship with the NY market and internal production dynamics. We’ll cover the three main types of differentials and explore how the data show us that there is significant variation in the relationship between differentials and the C market both from region to region and even from year to year.

Check out our previous article about what are differentials.

Types of Differentials

There are three main types of differentials. The first is the common benchmark. When we talk about differentials (diffs) from the perspective of time series analysis, it is important to distinguish common benchmarks from differentials. There are over 200 types of differentials in the market and these benchmarks are the most commonly referenced price differentials in coffee trading. A good example is Colombia UGQ, which acts as the common benchmark for Colombian differentials. If you know that a Colombian UGQ is +20, then you know that a Colombian EP is likely to be +22 and Colombian Supremos at about +25-26.

Another important type of differential is lower grade arabicas or coffees with a persistently high discount to the underlying futures market. The most common grade of a lower grade Arabica is Brazilian Rio Minas coffee. As a coffee that has strong demand in certain markets like the Middle East and Balkans, Rio Minas often trades more like a flat price contract. When futures prices are very low, Rio Minas diffs cannot be highly negative as the coffee would approach $0 cost. Therefore, Rio Minas has a relatively sticky price floor of around 70 cents/lb. On the upper range of the futures market, Rio Minas diffs often find themselves a better benchmark against Robusta futures prices as roasters look for alternative Robusta product to satisfy demand.

The last category of differentials is certified and government-controlled coffees. These differentials are often governed by a set of rules that dictate an additional premium (in the case of Rainforest Alliance), a combination of premium and a minimum price (in the case of Fair Trade), or a mandated price set by government officials (in the case of Ethiopia). Due to these rules, certified and government-controlled coffees are typically priced differently than most non-certified, non-controlled coffees.

In the next section, I will focus on the first type of diffs and analyze the benchmark diffs of Colombia UGQ, Honduras High Grown (HG), and Brazil 14/16 Fine Cup (FC). These are the most commonly mentioned and most actively traded arabica diffs on the market.

Analyzing the Relationship Between Common Benchmark Differentials and the NY Arabica Futures

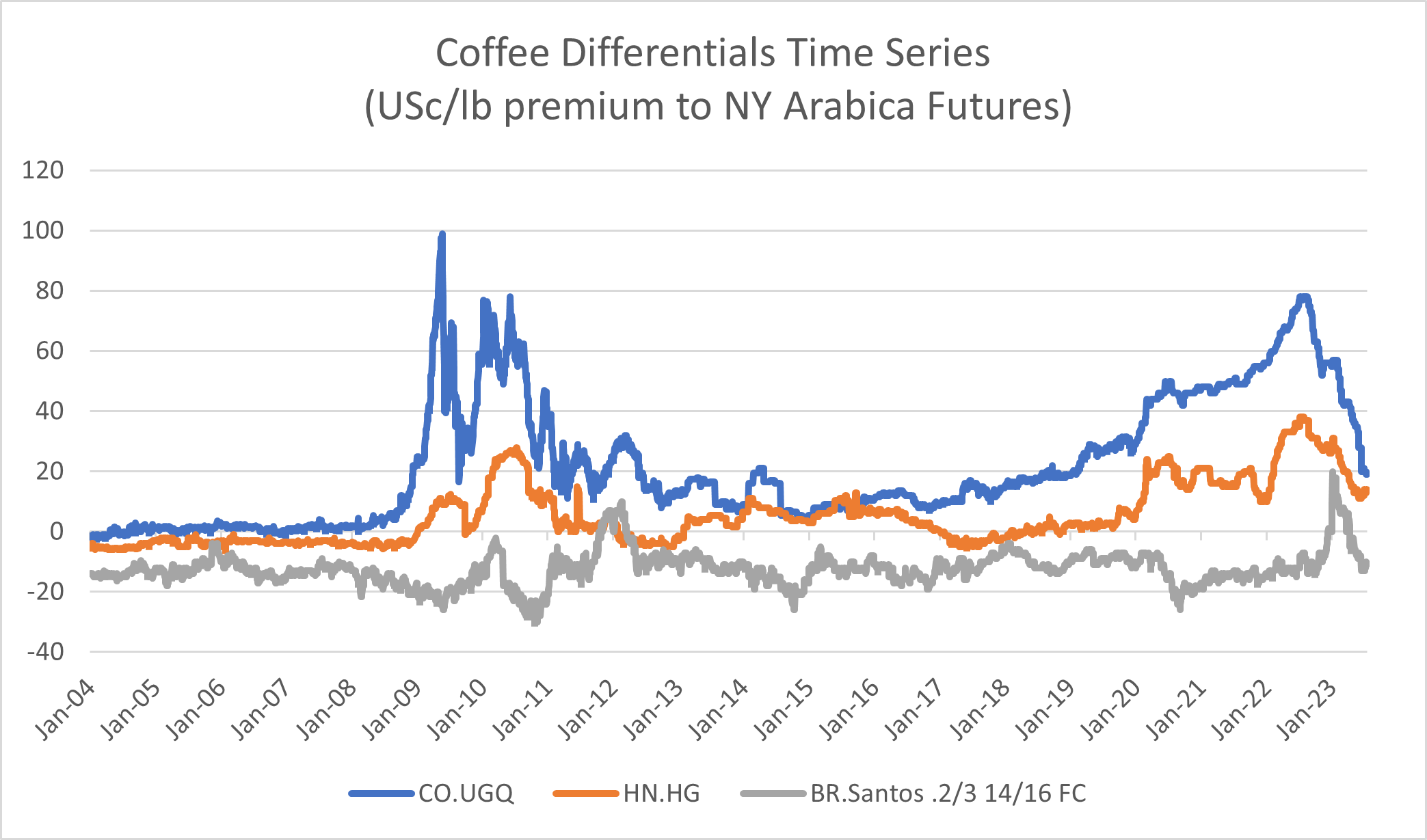

The table above shows the time series of differentials for the 3 benchmark qualities since 2004. As you can see, Colombian UGQ are by far the most volatile differential, seeing spikes up to +100 premium in 2009 and going up to +80 in 2022. Brazilian Fine Cup differentials also show a high amount of volatility, oscillating by as much as 40 cents in a single year (2011 and 2023 are examples).

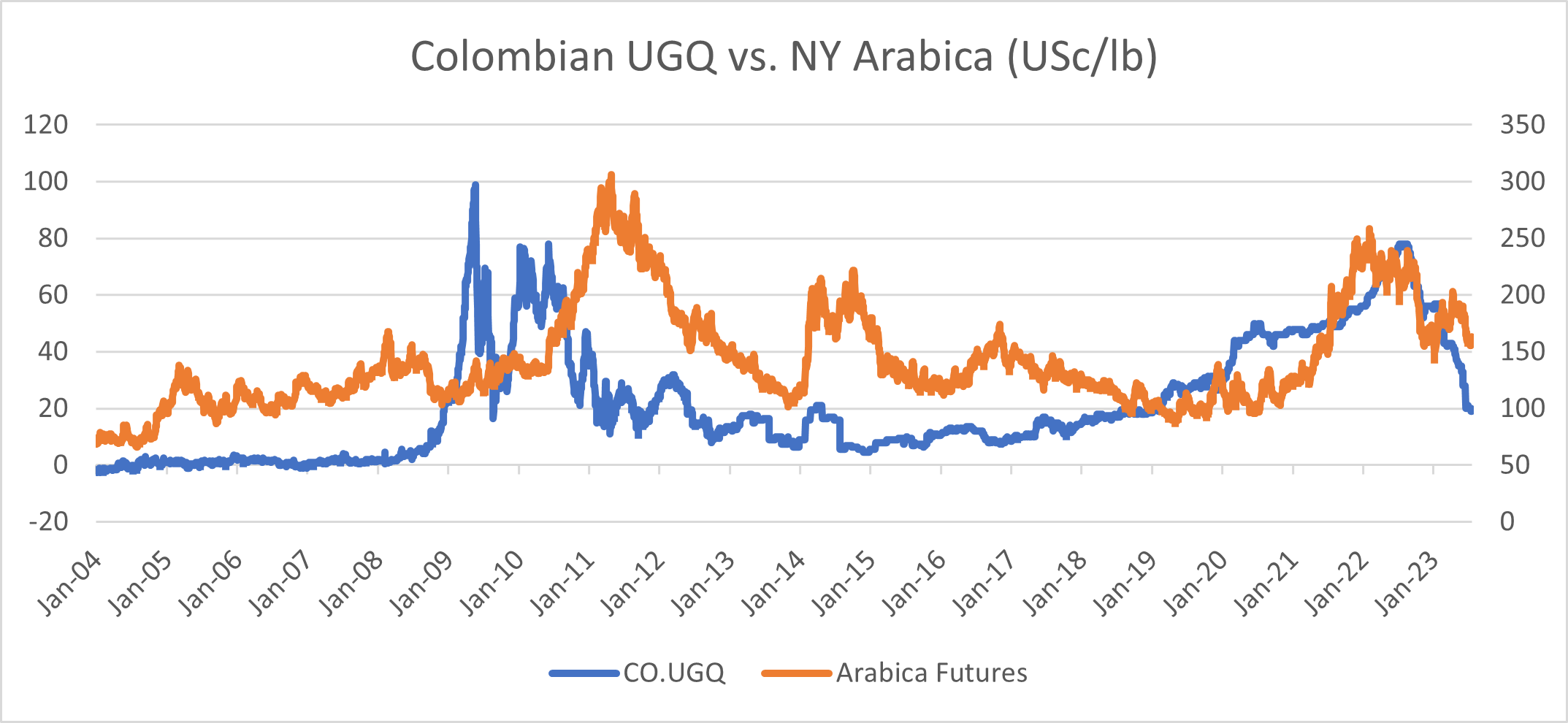

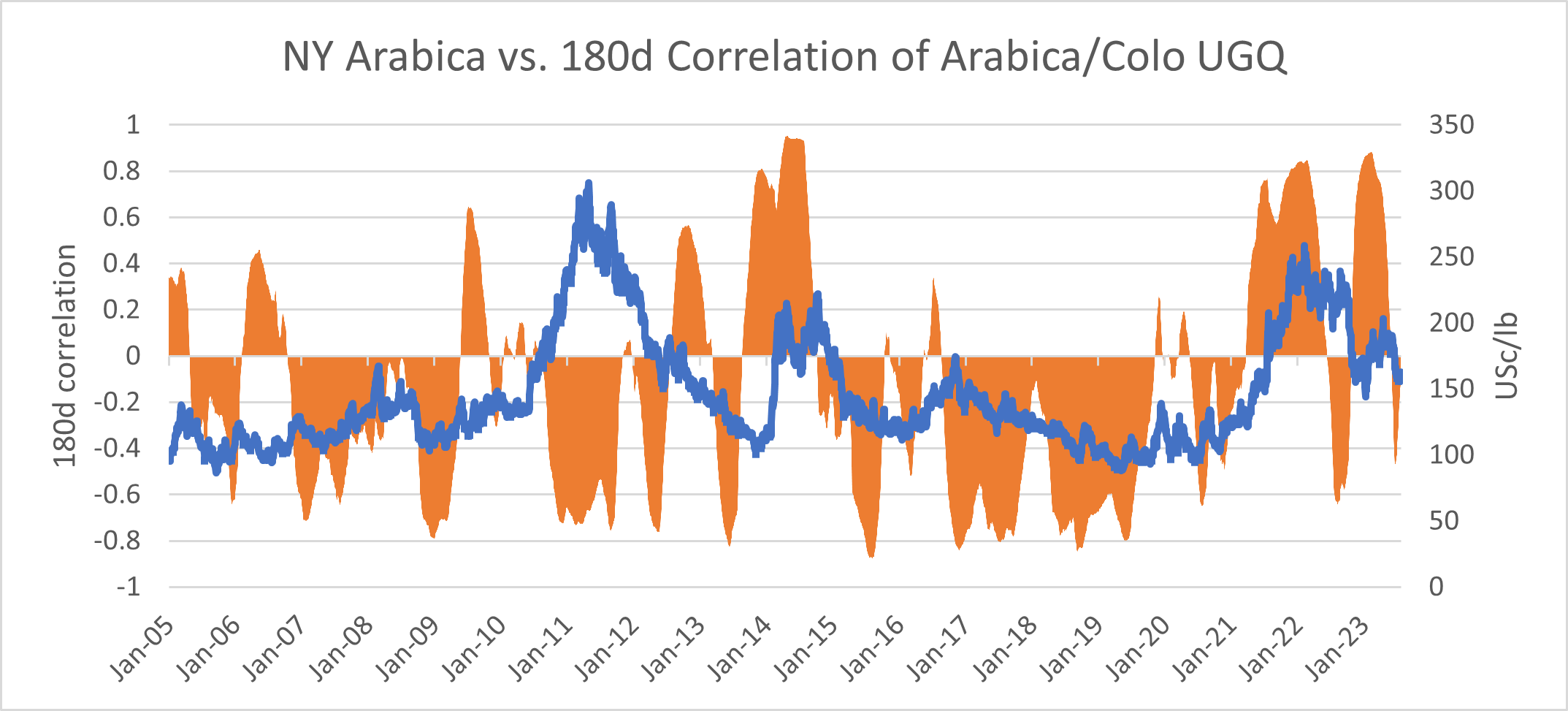

Looking at Colombian UGQ differentials against NY coffee futures prices (shown on 2 separate axes with differentials on the left and futures on the right in USc/lb), we can see that Colombian differentials have a positive relationship with futures price. On a rolling basis, the average 180 day correlation is -0.15, with a huge amount of oscillation. The second chart above shows the 180 day correlation of Colombian UGQ diff vs. NY Arabica futures. Interestingly, it seems that there is a correlation between Colombian UGQ increasing to +0.50 (or higher) and a subsequent rally in NY futures. However, it is outside the scope of this article to test the validity of the Colombian UGQ diff as a potential leading indicator for futures. The point I want to make from this analysis is that the typical adage of higher prices-lower diffs doesn’t work for Colombia, and it is more likely that looking at internal market dynamics of supply and demand for green coffee in Colombian is a better predictor for Colombian diffs than the NY futures market.

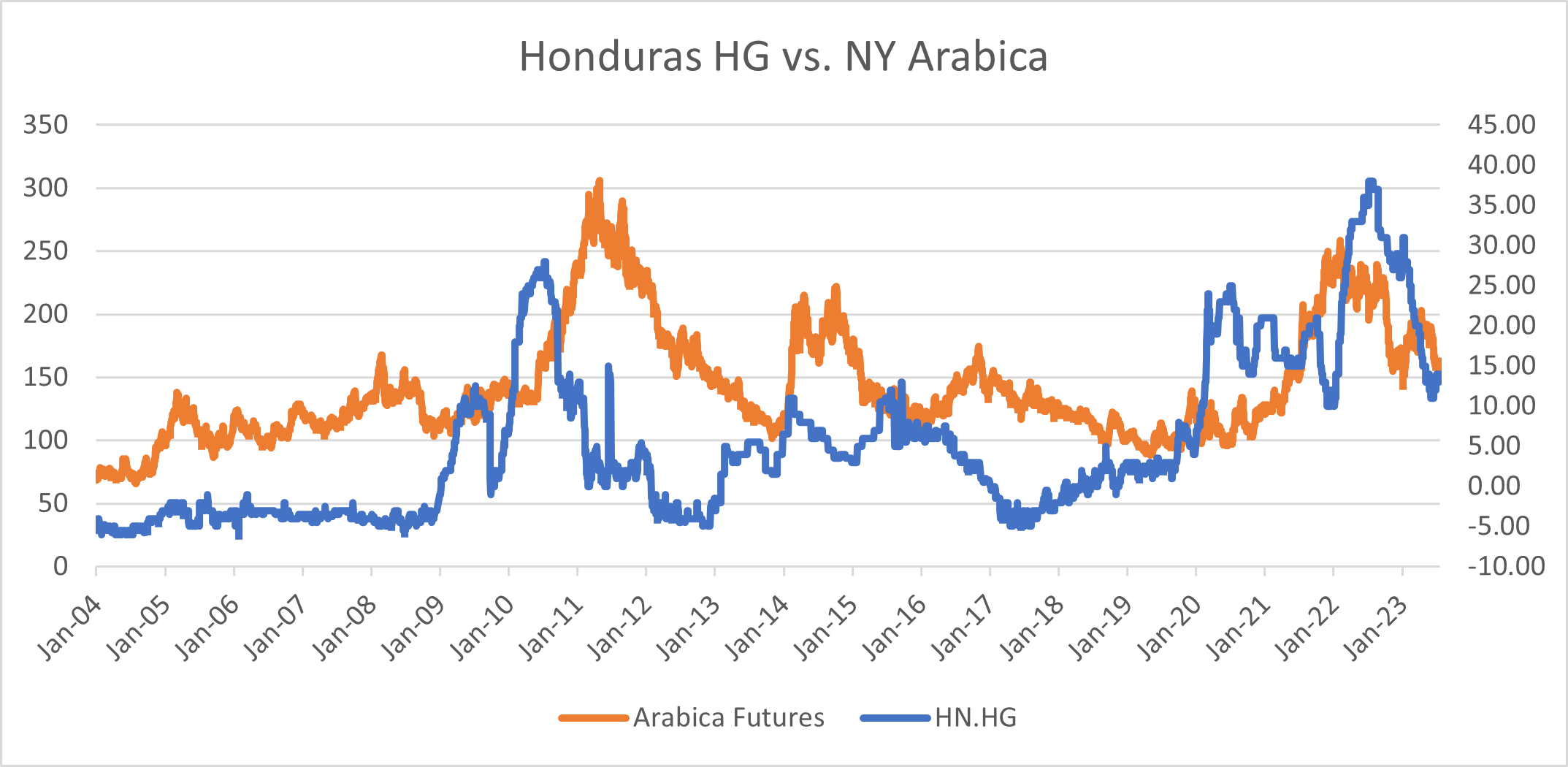

Moving to Honduras, we can see a far more dynamic picture with the NY Arabica market. It seems that Honduras HG differentials have 4 stories to show from the above time series. The first period, 2004-2009 shows the typical negative relationship between futures prices and diffs. A rally in futures brings diffs down to -4/-5 while a market collapse below $1 results in Honduras diffs going above tenderable parity (the value at which you can break even or make money by grading and certifying the coffee with ICE exchange) The second period is 2009-2013 where we saw a major deficit in Arabica globally. There, Honduras differentials form a strong leading indicator for both the futures rally and the subsequent futures collapse once the arabica deficit resolves with demand shifting strongly towards Robusta. The third period of 2013-2019 sees return to the common relationship of higher prices lower diffs and vice-versa on a more volatile scenario than 2004-2009. The drought in Brazil in 2014 brings Honduras diffs to below +5, and then the subsequent rally in 2016 - combined with an excellent Honduras crop - results in an oversupply of Honduras coffee and sees differentials break to tenderable levels for the exchange. Lower futures prices then see lower investment, and Honduras differentials climb steadily in 2019 and 2020. In the 4th story of 2020 to present, differentials for Honduras are much more dynamic and volatile, oscillating between +10 to as high as +37. Here the story is complicated by the logistics issues borne out of Covid as well as the long-term inversion in NY futures, but overall, I would say differentials for Honduras have behaved like they did in 2009-2013 when a spike indicated an imminent futures rally, and a collapse in Hondo HG diffs in late 2022 preceded the collapse of NY arabica futures.

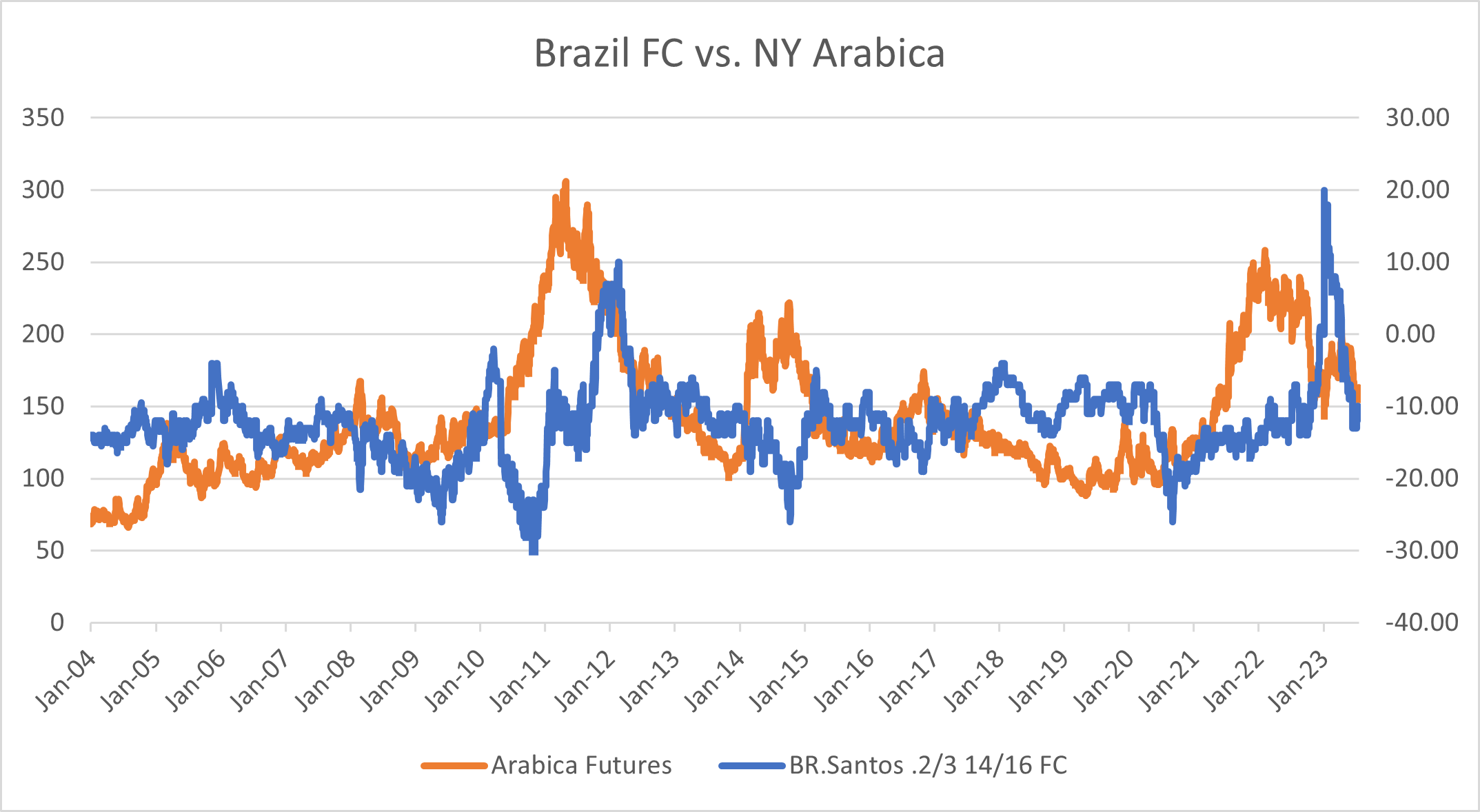

Lastly, looking at Brazilian FC diffs, we can finally see perhaps the clearest relationship in higher futures market leading to lower differentials and low futures market resulting in a rally in differentials. It makes sense that Brazil FC is the grade that follows this relationship most closely since Brazil is the dominant Arabica origin and large changes in Brazilian internal market dynamics have an overall impact on the whole coffee market and futures. The only two major exceptions to the common negative correlation (180 day rolling correlation is most negative at -0.24) were in 2011-2013 period during the historic rally in Arabica futures, and Q1 2023. I In the first scenario in 2012, Brazil had to win over roaster demand, which it did by being by far the cheapest Arabica around for a year while futures went to record highs. In a way, during that period, Brazil had to “decouple” from its historic relationship by attracting demand. However, in the following season it could not produce enough coffee during its off cycle to satisfy that demand, and futures had to readjust despite the overall futures market climbing higher. The last, much more recent scenario involved a historical rise of Fine Cup differentials to +20 after the futures market saw its most rapid collapse in history, falling from 218 in October 2022 to 144 by Jan 2023. It’s important to note that FC diffs didn’t materially change in the initial fall in the market from 218 to 175 during October 2022. Most of the appreciation happened below 150, when the Brazilian farmer chose to essentially stop selling coffee. Coinciding with the start of the new year, the Brazilian farmer was able to hold back supply enough to get roasters to pay up differentially by essentially creating a strong floor at 150 USC/lb flat price. In that regard, the market power of the Brazilian farmer is notable and, out of the three differential studied, Brazilian FC has the strongest correlation to the futures market.

To conclude, differentials follow complex pricing mechanisms that cannot be boiled down to the commercial trader’s the saying “higher prices-lower diffs”. Out of the 3 most common differentials studied above, it seems Brazil FC follows that concept the closest, while Colombian UGQs do not behave that way at all. Even for Brazil important internal dynamics of supply and demand as well as farmer retention strategies increasingly play a role in differential pricing. For a buyer it is important to understand these evolving dynamics by staying informed of crucial events at origin and maintaining good relationships with your coffee originators. The main takeaway regarding differential pricing is that relationships vary from origin to origin and are far more nuanced than the simple expectation of lower diffs when prices go higher and vice versa. While we see a stabilizing market environment for Arabica next year, we are still in a low availability environment for some origins and therefore should be careful expecting a quick return to historical norms.