Resources for Roasters

Monday, September 20, 2021

Unpacking Foreign Exchange

Forex, short for Foreign Exchange, is an essential part of the business of coffee trading. It can also be confusing, so we’ve spoken with Sébastien Hoste, Chief Operating Officer for Sucafina Europe, to get the basics about Forex and how it affects coffee prices and you.

What is Forex? Why does it matter?

Sébastien Hoste: Forex is an abbreviation of “Foreign Exchange.” It means the conversion from one currency to another.

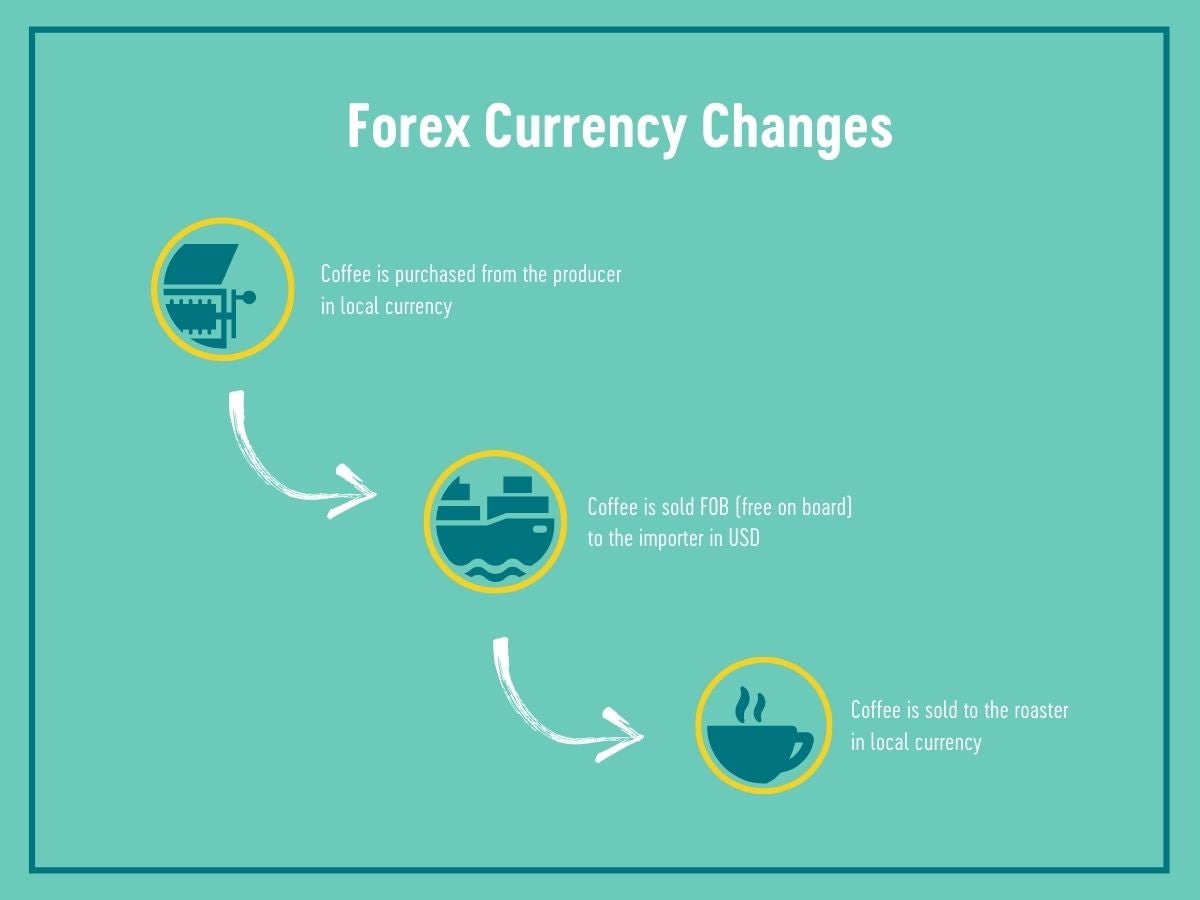

Forex is an important element of coffee trading because every step of the supply chain uses a different currency: farmers in Brazil are paid in BRL (Brazilian Reais), international trade is done in US Dollars (USD) and a coffee roaster will typically buy green coffee in their own currency.

In order to sell coffee between each party, we need to exchange currencies so we can make or receive payments in the accepted currency. Since the value of each currency fluctuates, the actual price each party pays in their own currency changes. Just as we hedge with the commodities market, we can also hedge with Forex by buying different currencies as the exchange rate changes.

How does Forex impact coffee prices?

SH: Depending on the conversion rates between those currencies and each buyer and seller, Forex can influence the price of coffee elsewhere in the supply chain.

While the biggest influence on commercial coffees will always come from the market levels of the New York C (Arabica) or London (Robusta) markets, Forex definitely has an influence and can directly impact how much you’ll pay.

For the FOB price, the producer or exporter is paid in local currency. Then, the importer will pay for the coffee in USD and, in turn, sell that coffee at the local currency of the consuming country. Depending on Forex rates, the price the importer – and by extension the roasters – pay for coffee changes.

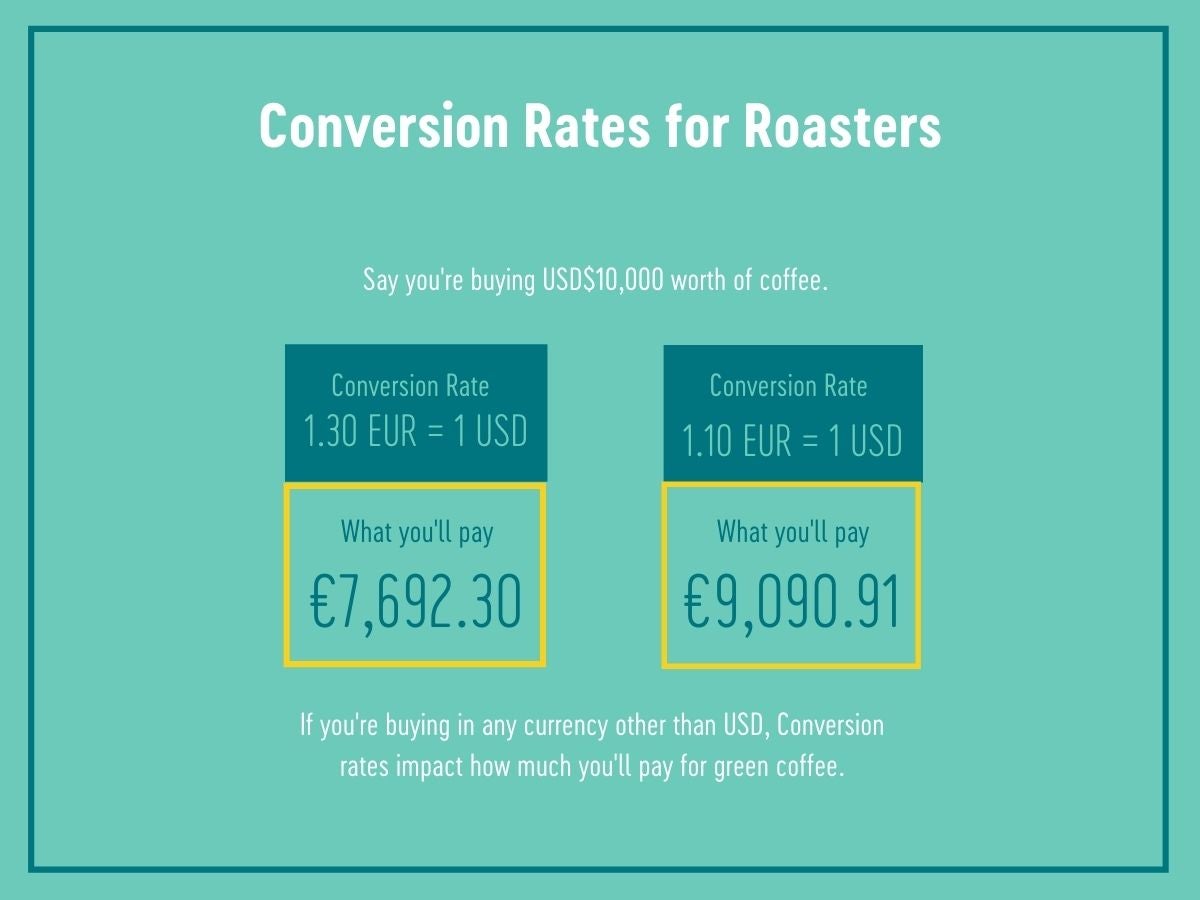

Whether you’re buying directly or not, the FOB price impacts the cost of green coffee to the roaster. If you’re a roaster based in Europe and your functional currency is EUR, you benefit when the EUR is stronger than the USD, because that means the functional cost to you will be lower. Imagine you buy coffee worth 10,000 USD. A conversion rate where 1.30 EUR equals 1 USD will mean you pay 7,692.30 EUR. With a conversion rate at 1.10 EUR to USD, the same lot will cost you 9,090.91 EUR and that’s a significant difference for a roaster.

If you’re a roaster buying your green coffee in USD, this doesn’t affect you as much, but it will still impact how much the importer – and later you – will pay to purchase coffee from producers or exporters.

Coffee prices are also strongly impacted by the value of the Brazilian Reais (BRL). Since Brazil is the world’s largest coffee producer, how much coffee is produced there – and how much each party pays for it – directly impacts the global coffee price.

When the BRL depreciates (is worth less compared to other currencies, mainly USD) coffee prices in local terms will increase. Conversely, when the BRL appreciates (is worth more), local prices will decrease comparatively.

These price changes also impact global sales because when the BRL depreciates, Brazilian producers are more competitive and able to sell their coffees at lower prices and still turn a profit (because they are receiving a higher local price). In more extreme cases, this can mean that producers elsewhere have trouble covering their costs because buyers can purchase cheaper coffees from Brazil. This means that Brazilian producers will receive better prices and have larger margins than those in countries whose currency remains stronger and those in such countries will struggle to stay competitive against lower-costs in Brazil.

Another way prices in Brazil impact the global market is in the longer term. When producers make a good profit on their coffee, they are likely to reinvest some of that profit in new trees or farm renovations. Conversely, several tough price years may mean that producers do not invest in their farms and overall production in Brazil may decrease. On a country-wide scale, this can impact the amount of coffee available in future years and sway the balance of supply and demand, pushing coffee prices up or down, depending on the cycle.

What are the major factors that influence Forex rates? How do you analyze them?

SH: Currency rates are influenced by multiple factors such as the local economy, inflation, politics (elections etc.), monetary decisions by central banks, interest rates and more. In the last year and a half, we’ve also seen currency rates influenced by how countries deal with coronavirus, including lockdowns and vaccination rates.

These factors can be monitored like other economic data, but it’s also important to closely follow what’s happening in the world. Here at Sucafina, we have a weekly call between traders and origin personnel to discuss the global market and local news that could have a global influence. This information is crucial to helping us understand trends.

Do I need to do anything differently when I buy my coffee?

SH: Once a contract is issued, Sucafina hedges our currency exposure to ensure you receive the best possible rates at any point in time. It does, however, mean that the rate is “locked in” once the contract is issued, so whether the market goes up or down, you’ll be getting the market level from the time the contract was issued.

In practice, this means that you’ll know your costs ahead of time and won’t have to worry about planning for the absolute best moment to contract your coffee. You can order your coffee when you need it and be rest assured that you’re getting the best rate possible.

Have more questions about Forex and how it affects your business? We’re here to help! Reach out with any questions.